Industry 4.0 In A Pandemic World

Apr 08, 2021

In our last manufacturing-focused blog, we explored the topic of the fourth industrial revolution known as Industry 4.0. This highly developed revolution focuses on the use of technology, automation, and digitization for operational efficiency. Many are now curious to know how this new phase of manufacturing was impacted by the disruption of the pandemic. With a vast shift from in-person work to a more remote setup, Industry 4.0 experienced a surge in the scaling of related technologies.

According to a survey by McKinsey, of their 400 respondents, 94% of respondents told noted that Industry 4.0 had helped them to keep their operations running during the crisis, and 56% percent said these technologies had been critical to their crisis responses. For those organizations who had already taken the leap to incorporate Industry 4.0 into their daily operations, the pandemic was a win situation. These early adopters were simply able to rely on their automation to overcome the loss of physical presence in their factories and at the same time utilize their real-time data analytics to assess their operations and make prompt adjustments.

For others, the pandemic was a wake-up call. Manufacturers who have yet to make the transition to Industry 4.0 were met with the stark reality of being unable to pivot during the disruption which left them negatively impacted. According to the McKinsey survey, 56% of respondents that hadn’t implemented Industry 4.0 technologies prior to COVID-19 found themselves constrained in their ability to respond to COVID-19 in the absence of digital technologies to support them.

While the pandemic made organizations realize the importance of Industry 4.0. It has also hindered progress. For some, the pandemic wreaked havoc on cash flow and talent creating a sort of catch-22. The need for automation and digitization is apparent, but without the capital to support the transition, manufacturers are stuck in a rock and a hard place.

So what is next? Manufacturers must first recognize the value-add of Industry 4.0 and commit to scaling their operations to include features of this forward-thinking revolution. Once committed, the next step is to develop a detailed plan. Given limited resources, having a strategic approach will ultimately maximize the benefits of smart technology without having to reprogram due to short-fixes. The biggest hurdle is making the decision to scale and take the first step. Whether it’s setting up your current system to pull data in an efficient manner for future data analytic software or focusing on best practices for remote working, committing to Industry 4.0 is the first step. Don’t make the mistake of discounting Industry 4.0, it could be deadly in a time of disruption. Organizations that learned from the pandemic, have embraced this new revolution, and can be nimble during uncertainty are those who will survive and thrive.

Categories: COVID-19, Manufacturing & Distribution

$1.9 trillion American Rescue Plan Relief Bill Signed Into Law

Mar 11, 2021

Today, President Biden signed into law the American Rescue Plan, a $1.9 trillion stimulus package that allocates federal funding to a variety of matters, including aid for vaccinations and testing, state and local governments, schools, rental assistance, restaurants, and the airline industry. It also includes several tax-related provisions and additional business relief.

Here are some of the key individuals and businesses provisions:

Individuals

Stimulus Checks – Funding has been allocated for a third round of stimulus checks. Notable changes include the income cutoff at which payments phase out from $100,000 to $80,000 for individuals and $200,000 to $160,000 for couples filing jointly. Those who qualify will receive the full direct payment of $1,400 per person. Individuals will also receive an additional $1,400 payment for each dependent claimed on their tax returns. Dependents over the age of 17 and qualifying relatives who are claimed as dependents also now qualify.

Unemployment Benefits – Unemployment benefits previously set to expire on March 14 have now been extended almost 6 months to September 6, 2021. In addition, recipients will receive an extra $300 per week through the fall deadline along with making the first $10,200 of benefit payment nontaxable for households with incomed below $150,000. The 10,200 exclusion only applies to benefits received last year, 2020.

Child Tax Credit – A temporary expansion of the existing child tax credit with significant adjustments including those noted below.

- 17-year-old- children are now able to qualify.

- Increase of the credit to $3,000 per child ages 6 to 17 or $3,600 per child under the age of 6

- Removal of the $2,500 earning floor

- Credit is now fully refundable

- A 50% credit advancement by the IRS paid in periodic payment from July 2021 to December 2021

Low-Income Support – In an effort to target low-income families afflicted by the pandemic, $4.5 billion has been set aside for the Low Income Home Energy Assistance Program, or LIHEAP, to help families with home heating and cooling costs.

Businesses

Employee Retention Tax Credit (ERTC) – The expanded ERTC provisions under the Consolidated Appropriations Act (CAA) were set to expire on July 1 which has now been extended through December 31, 2021, for eligible employers. In addition, eligibility has been expanded to include start-up businesses established after February 15, 2020, with annual gross receipts of up to $1 million.

Paycheck Protection Program (PPP) – Provides an additional $7.25 billion for the Paycheck Protection Program (PPP) and expands eligibility to include nonprofit entities. Importantly, eligible nonprofit organizations would now qualify for a PPP loan as long as they employ not more than 500 employees per physical location (300 per physical location for Second Draw loans) and meet all other criteria.

Economic Injury Disaster Loan (EIDL) – The new law also includes an additional $15 billion in funding for targeted EIDL advances. One-third of this EIDL funding is earmarked for businesses that suffered a revenue loss of greater than 50 percent and employ fewer than 10 people.

Families First Coronavirus Response Act (FFCRA) Paid Leave Credits – The new law also extends these tax credit provisions through September 30, 2021. However, adjustments have been made for wages paid between April 1, 2021, and September 30, 2021, including increasing eligible wages to $12,000 per employee (up from $10,000 in 2020), expanding types of leave to include vaccination, and covering as many as 60 days of paid family leave for self-employed individuals (instead of 50 days under previous law).

Industry-Specific Funding

- Restaurants – A $25 billion Restaurant Revitalization Fund has been established for 2021. Grant amounts will be limited to a restaurant’s pandemic-related revenue loss (measured as the difference in gross receipts in 2020 compared to 2019) up to $10 million and limited to $5 million per physical location. For more details on this U.S. Small Business Administration (SBA) administered program, check out our blog.

Categories: COVID-19

SBA Releases New Forms In Preparation for Paycheck Protection Program Re-Opening

Jan 11, 2021

The U.S. Small Business Administration (SBA), in consultation with the Treasury Department, announced the Paycheck Protection Program (PPP) will reopen today initially for community financial institutions (CFIs) that serve minority- and women-owned businesses to make loans. Specifically, CFIs can begin making loans to first-time PPP borrowers today and second-time PPP borrowers on Wednesday.

The SBA and Treasury said the PPP would open to all lenders a few days after the opening for CFIs, but they did not specify a date. Borrower loan application forms were also released:

- Form 2483 – Paycheck Protection Program Borrower Application Form and,

- Form 2483-SD – PPP Second Draw Borrower Application Form.

Form 2483 is updated from previous iterations starting with the original PPP program. Form 2483-SD is a new form for qualified PPP borrowers to seek a second draw of a forgivable loan as they try to navigate economic seas churning in the throes of the COVID-19 pandemic.

Finally, the SBA released additional guidance outlining top-line summaries of the first-draw and second-draw PPP loans and a pair of procedural notices.

- Top-Line Overview of First Draw PPP Loans

- Top-Line Overview of Second Draw PPP Loans

- Procedural Notice – Modifications to SBA Forms 3506, 3507 and 750 CA (PPP only)

- Procedural Notice – SBA Procedural Notice on Repeal of EIDL Advance Deduction Requirement

For more information regarding the PPP and second-draw loans under the Consolidated Appropriates Act, 2021, check out our latest webinar here or review our PPP Application Guide here. As always, connect with your William Vaughan Company advisor for questions or concerns.

Categories: COVID-19

Employee Retention Tax Credit Expanded Under CAA

Jan 06, 2021

Prior to the passage of the Consolidated Appropriations Act, 2021, (CAA), the Employee Retention Tax Credit (ERTC) was as afterthought reserved to the deepest recesses of most employers’ minds as in the original CARES Act, taking a PPP loan and requesting subsequent forgiveness of that loan precluded businesses from also taking the ERTC. At best, the ERTC was a backup option for businesses that failed to request a PPP loan on time or had too many employees for the PPP loan. Now, however, with the passage of the Consolidated Appropriations Act, 2021 just days ago, the ERTC is retroactively available to employers even if they took a PPP loan.

The ERTC is a refundable payroll tax credit that can be taken against employment taxes equal to 50 percent of the qualified wages an employer pays to employees after March 12, 2020, and through December 31, 2020.

This post dives into the details of the ERTC and the mechanics of how employers can capitalize on this additional benefit.

The ERTC for 2020

As noted above, employers that borrowed a PPP loan can now also claim the ERTC for 2020 but not on the same dollars of payroll costs. What this means is wages and health care costs used in calculating the ERTC cannot also be used in deriving PPP loan forgiveness. Simply put, there’s no double-dipping. In order the qualify for the ERTC an employer must satisfy one of the following conditions:

- Full or partial suspension of business operations during any calendar quarter due to government orders limiting commerce, travel, or group meetings as a result of COVID-19 (this does not include individuals business choices or simple advisories by public officials), OR

- A significant (>50%) decline in gross receipts in a 2020 calendar quarter in relation to the same quarter in 2019.

If the significant gross receipts decline qualification is met, every quarter thereafter is considered a qualifying quarter until the first day of a calendar quarter following a quarter in which gross receipts returned to at least 80% of the gross receipts in the same quarter during 2019.

Example: Gross receipts for 2020 are $100,000, $150,000, $100,000, and $120,000 for Q1, Q2, Q3, and Q4 of 2019 respectively. Gross receipts are $45,000, $112,500, $83,000, and $90,000 for Q1, Q2, Q3, and Q4 of 2020 respectively. The employer would qualify for the ERTC beginning in quarter one since gross receipts decreased 55%. Quarter four would not be a qualified quarter since gross receipts rose back to 83% of the prior year’s receipts during the 3rd quarter.

If a business began in the middle of a quarter, gross receipts would be extrapolated to estimate the total quarter’s receipts. For example, if a business began on June 1st and reported $50,000 in gross receipts for the month, the business would use $150,000 of gross receipts for the 2nd quarter of 2019 ($50,000 x 3 months). Extrapolated gross receipts would be used for any prior quarter in 2019.

Once an employer has determined they qualify under one of the stipulations above, the next step is to determine on which wages to calculate the credit. First, in the event that a business is fully or partially suspended, only wages paid during the period of suspension can be used in calculating the ERTC. If the business qualifies based on the gross receipts test, the wages from each qualifying quarter can be used. The number of average monthly full-time employees (FTEs) significantly affects what wages can be used under either qualifying event. If the employer had less than or equal to 100 average monthly (FTEs) in 2019, then all wages paid to all employees during the eligible time period can give rise to a credit. If however, the employer had greater than 100 average monthly FTEs in 2019, only wages paid to employees during the eligible time period to NOT WORK are eligible for the credit. For purposes of this rule, and FTE is an employee who, for any calendar month in 2019, had an average of at least 30 hours of service per week or 130 for the month. This is not a fractional calculation. All employees working less than 30 hours count as zero FTEs in the average monthly calculation.

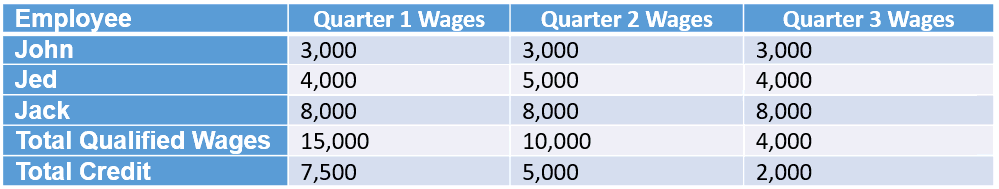

After considering all of the qualifications, the calculation of the credit is pretty straightforward. The ERTC is 50% of up to $10,000 of wages, including certain health insurance costs per employee per year. Let’s look at a simple example.

As seen in the table above, Jed’s quarter 3 wages are limited to $1,000 since $9,000 of his wages were already accumulated in quarters 1 and 2. Likewise, Jack’s wages are limited beginning in the second quarter and none of his wages are eligible in quarter 3.

One caveat to keep in mind when running the numbers on this credit is that wages up to the amount of the credit are not allowed as a deduction on the employer’s income tax return. So if an employer claims a $5,000 credit on $10,000 of wages, $5,000 of those wages are non-deductible for tax purposes.

As for businesses with multiple entities or subsidiaries, the following aggregation rules apply:

- if ONE business in the group has been partially or fully suspended, then all businesses in the group are considered to have been partially or fully suspended

- when calculating the percentage decline in gross receipts quarter over quarter, the gross receipts of ALL aggregated businesses must be taken into account

- when determining FTEs for purposes of the 100 FTE threshold, employees from all of the businesses in the group must be added together

Finally, in order to claim this credit, the employer can use one of two approaches. First, employers will report their total qualified wages and related health insurance costs for each quarter on their quarterly payroll tax returns (Form 941 for most employers). The credit is then taken against amounts that would have otherwise been deposited including federal income tax withheld, the employer’s share of Social Security and Medicare tax, and the employees’ share of Social Security and Medicare tax. The second acceptable method is to request an advance of the ERTC by submitting Form 7200.

OK – intermission. Stand up, stretch, use the restroom, and refill your coffee. We made it through the 2020 provisions of the Employee Retention Tax Credit. Next, we are going to breeze through the extension of the ERTC into 2021 provided by the Consolidated Appropriations Act, 2021. Here we go…

Changes for the 2021 ERTC Program

Congress voted to extend the ERTC into 2021 with the program set to end on June 30, 2021. The credit percentage has been increased from 50% to 70% and it is now calculated on $10,000 of wages per employee per quarter. In addition, the FTE threshold is up to 500 FTEs vs. 100 in 2020 and, what is considered a significant reduction in gross receipts quarter over quarter is down from greater than 50% to greater than 20%. Furthermore, congress tossed up a softball by including the provision that, when considering gross receipts for the first quarter of 2021, the employer can elect to compare Q4 of 2020 vs. Q4 of 2019 instead of Q1 of 2021 vs. Q1 of 2019 in the event that there’s a benefit to doing so.

One additional rule put in place for 2021 is that the advance credit claimed via Form 7200 cannot exceed 70% of the average quarterly wages paid in 2019.

As can be expected, the various allocations and calculations possible under the multitude of possible scenarios are far too comprehensive to include in the overview of this blog. When considering the ERTC for your business, do not hesitate to reach out to a William Vaughan adviser for assistance on maximizing the benefits of this program.

By: Jon Floering, CPA

Categories: COVID-19, Tax Planning

New Guidance Released on Deductibility of Expenses Paid with PPP Funds

Nov 19, 2020

Yesterday, the U.S. Treasury Department and Internal Revenue Service (IRS) released guidance clarifying the deductibility of expenses paid with paycheck protection program (PPP) loan funds.

The two significant rulings can be found here: Revenue Ruling 2020-27 and Revenue Procedure 2020-51. Both address issues related to the deductibility of expenses paid with PPP funds.

What is the significance of the new guidance?

Previously, it was unclear what would happen if a taxpayer incurred the expenses in one year (2020), but received forgiveness in the next year (2021).

Rev. Rul. 2020-27 states if a business reasonably believes a PPP loan will be forgiven in the future, expenses related to the loan are not deductible, whether the business has filed for forgiveness or not. Meaning, if you used all of your PPP funds in 2020 and expect to receive full forgiveness, those expenses are not deductible, regardless of whether or not you have applied for or have received forgiveness notification as of the end of 2020.

What happens if loan forgiveness is partially or fully denied in 2021 after one has filed their 2020 return?

Revenue Procedure 2020-51 establishes a safe harbor for taxpayers whose loan forgiveness applications are partially or fully denied, or who decide not to apply for forgiveness after filing their 2020 tax return.

While these expenses may ultimately become deductible with a future act of Congress, we encourage you to connect with your William Vaughan Company advisor to assist you in determining the best path forward for you and your business.

Need further PPP guidance? Check out our COVID-19 Resource Center.

Categories: COVID-19, Other Resources, Tax Planning