Dear Clients and Friends,

At William Vaughan Company, the health and safety of our employees, clients, and community is of paramount importance. We recognize the ongoing impact of the Coronavirus, and are focused on how we can best protect our clients and staff while continuing to providing exceptional service to the community.

We have continuously invested in technology, and as a result, have the ability to exchange information and perform a significant portion of our work remotely. I would encourage all of you to be proactive about the use of technology when working with us during this uncertain time.

While it’s still difficult to predict the full extent of the impact of COVID-19, we are closely monitoring this rapidly evolving situation. As part of our commitment to our clients, we would like to share the following resources with you to offer guidance on minimizing the impact on you and your business. If you have questions, please contact your William Vaughan Company advisor.

Stay Safe,

WVC Insights

Employee Retention Tax Credit (ERTC) Resources

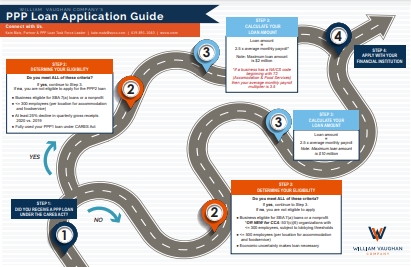

PPP Loan Application Guide

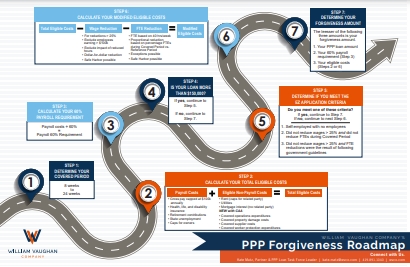

PPP Forgiveness Roadmap – UPDATED WITH CAA

WVC PPP Loan Amount Calculator

WVC PPP Loan Forgiveness Calculator

Consolidated Appropriations Act, 2021

On December 27, President Donald Trump signed into law the Consolidated Appropriations Act, 2021, the second-largest stimulus bill in modern history. Here are some various resources to help you navigate this massive 5,600-page law:

The CARES Act

Friday, March 27, 2020, President Trump signed a bipartisan relief bill entitled the “Coronavirus Aid, Relief, and Economic Security Act” or the CARES Act. The $2 trillion coronavirus response bill is intended to provide relief across America and to keep businesses and individuals afloat during the unprecedented freeze on most American life.

The CARES Act: What You Need to Know

Paycheck Protection Program Borrower Application Form

U.S. Treasury SBA Business Loan Program Temporary Changes; Paycheck Protection Program

Other Resources & Guidance

Centers for Disease Control (CDC)

The key resource for national information on the spread of COVID-19, what you can do to protect yourself, and what to do if you get sick.

For tips on how you can prevent and prepare your employees along with links and checklists for taking action.

Ohio Department of Jobs & Family Services

For information on coronavirus and unemployment insurance benefits. Employers can distribute this Mass Layoff Instruction Sheet to their employees laid off because of the COVID-19 pandemic to expedite their claim process.

CDC’s Interim Guidance for Businesses and Employers

OHSA Guidance on Preparing Workplaces for COVID-19

Beginning Monday, April 20, the U.S. Chamber of Commerce Foundation will launch its “Save Small Businesses Fund,” a nationwide program to address small businesses’ immediate needs, mitigate closures and job losses and mobilize support for long-term recovery. The Foundation will provide $5,000 supplemental grants to small employers in economically vulnerable communities based on the Distressed Communities Index. Click here for more information.

U.S. Small Business Association

The SBA is working directly with state Governors to provide targeted, low-interest loans to small businesses and non-profits that have been severely impacted by the Coronavirus (COVID-19)

Ohio Resources for Economic Support

The IRS has established a special section focused on steps to help taxpayers, businesses and others affected by the coronavirus. This page will be updated as new information is available.

IBIS World Industry Impacts of the Coronavirus

Restaurants

- Restaurant Employee Relief Fund

- The Ohio Restaurant Association is posting memos, recommendations, updates and news on a special page on their website.

- The Ohio Department of Commerce will immediately begin offering a one-time liquor buyback option to support bars and restaurants. Click here for more information.

- Keeping Your Restaurant Afloat During the Coronavirus Pandemic

Dental Offices

Hospitality

Trucking & Transportation

- ODOT: Special Blanket Permit for Haulers – In an effort to assist in the state’s response to the COVID-19 outbreak, the Ohio Department of Transportation has approved a special blanket permit for haulers carrying heavy or oversized loads of food, non-alcoholic beverages, medical supplies, cleaning products, and other household goods.

WVC Shorts

Tune into our WVC SHORTS! These quick videos are aimed to help you answer some of your most pressing questions and understand relevant topics of interest. For more videos, click here.