Business Auto Deductions

Apr 02, 2015

Do you drive your car for business purposes? The costs of operating and maintaining your vehicle are potentially deductible. Here are some guidelines.

Two Methods

The IRS provides two basic methods for computing deductions for the business use of an automobile.

Actual expense method. With the actual expense method, you deduct the actual costs of operation, including licenses, registration fees, garage rent, repairs, gas, oil, tolls, and insurance. Additionally, you may claim depreciation deductions (and/or elect expensing under Section 179). If the car is leased, you deduct your lease payments rather than depreciation. (Certain limits apply.)

Standard mileage rate. Alternatively, you may choose to use an IRS-provided standard mileage rate. With this method, you multiply the number of business miles you drive during the year by the applicable rate (57.5¢ per mile for 2015). When you use the standard mileage rate, you don’t separately deduct expenses such as gasoline, oil, insurance, repairs and maintenance, depreciation, or lease payments. However, business-related parking fees and tolls are separately deductible.

Which Should You Use?

Generally, you will want to use the method that produces the largest deduction. If your vehicle is costly to own and operate, the actual expense method may be more advantageous. Conversely, if your vehicle is fuel efficient and/or inexpensive, the simpler standard mileage rate method may be a better choice.

Generally, you will want to use the method that produces the largest deduction. If your vehicle is costly to own and operate, the actual expense method may be more advantageous. Conversely, if your vehicle is fuel efficient and/or inexpensive, the simpler standard mileage rate method may be a better choice.

With either method, the IRS requires that you keep records that substantiate your business use of the car: the date, place, business purpose, and number of miles you travel. When you use the actual expense method, you’ll also need records substantiating the amount and date of car-related expenditures. You can avoid having to retain receipts by using the standard mileage rate.

If you decide to use the standard mileage rate for a car you own, you may switch to deducting your actual business-related car expenses in a later year. However, you won’t be able to claim accelerated depreciation deductions for the car. With an auto tax deduction on a leased car, you have less flexibility. If you choose the standard mileage rate the first year, you must use it for the entire lease period.

Personal and Business Use

If you use your car for both personal and business purposes, you must keep track of your mileage for each purpose. To figure the percentage of qualified business use, you divide the business mileage by the total mileage driven. Then multiply that percentage by your total expenses.

Categories: Uncategorized

Capitalizing on a Tax Holiday

Mar 27, 2015

Net long-term capital gain is generally taxed at a relatively low 15% or 20% rate in 2015. But low-bracket taxpayers enjoy an even better deal: Their net capital gain is tax-free (i.e., the tax rate on the gain is 0%) to the extent it would have been taxed at the 10% or 15% rate if it had been ordinary income instead of capital gain.

Net long-term capital gain is generally taxed at a relatively low 15% or 20% rate in 2015. But low-bracket taxpayers enjoy an even better deal: Their net capital gain is tax-free (i.e., the tax rate on the gain is 0%) to the extent it would have been taxed at the 10% or 15% rate if it had been ordinary income instead of capital gain.

Are tax-free capital gains out of your reach if your marginal tax rate is higher than 15%? Maybe not. Here are a few family gifting strategies that could save you money:

Gift to parent. If you’re helping your folks financially, a gift of appreciated stock might be a tax-smart way to do it. As long as your parents’ taxable income stays below $74,900* in 2015, they can sell the stock and a 0% rate would apply to the capital gain.

Gift to child/grandchild. Until children reach age 19 (24 if they’re full-time students), the 0% rate generally would apply to only a limited amount of capital gain because of the “kiddie tax” rules.** But these rules aren’t an issue for older children (or for children ages 18-23 who have earned income exceeding one-half of their support).

You can make tax-free gifts of up to $14,000 (per recipient) in 2015 without using up any of your $5.43 million estate- and gift-tax exemption amount.

- Substitute $37,450 for $74,900 if your parent is a single taxpayer. These figures represent the top of the 15% bracket for single and married-joint taxpayers, respectively.

** Under the kiddie tax rules, children pay tax at their parents’ highest rate on unearned income over $2,100 (in 2015).

Categories: Uncategorized

Active Versus Passive Appreciation

Mar 23, 2015

When Jed Clampett went to shoot at a critter, he missed his target but tapped into an oil gusher. Old Jed, the lead character in TV’s “The Beverly Hillbillies,” got rich and moved to the land of swimming pools and movie stars. The “Jed Clampett defense” is what some court pundits are calling the position an oil billionaire took in his recent divorce case, according to an article in The New York Times. The defense is based on the “active versus passive appreciation” concept in divorce law.

Luck versus skill: In some states, if a spouse owns an asset before the marriage, the increase in value of that asset is not subject to division if the increase was due to “passive” appreciation, that is, if the asset’s value increases due to factors outside of either spouse’s control. But if the value increases due to the efforts or skills of a spouse, it is considered “active” and is thus subject to division in a divorce. So the question comes down to luck versus skill.

Luck versus skill: In some states, if a spouse owns an asset before the marriage, the increase in value of that asset is not subject to division if the increase was due to “passive” appreciation, that is, if the asset’s value increases due to factors outside of either spouse’s control. But if the value increases due to the efforts or skills of a spouse, it is considered “active” and is thus subject to division in a divorce. So the question comes down to luck versus skill.

If this correlates with you, make sure you discuss “active versus passive appreciation” with your attorney and valuator. Depending on the state your case is in, this could have a large impact on your financial outcome.

By: Ryan Leininger, CPA, CVA

Categories: Uncategorized

Frequent Asked Questions About Form 1099 Misc

Mar 17, 2015

Each year, I receive multiple questions during the first few months regarding issuing 1099 Misc forms. Many of the questions are general in nature. For example, “when are the forms due?” However, there are always some questions that are not a quick one or two-word answer.

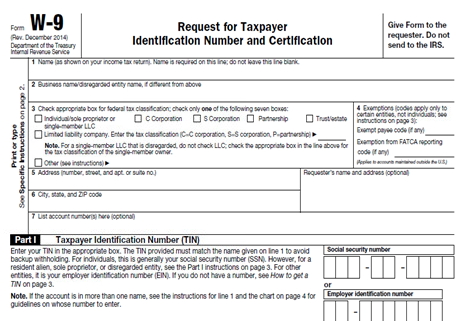

Do we need to send a 1099 Misc to a company if they are an LLC?Answer: It depends on how the LLC is being taxed by the IRS? The best way to find out is to ask the company to complete a Form W-9, or Request for Taxpayer ID number. In Box 3, if the vendor checks the first box Individual/Sole Proprietor or single member LLC or the Partnership box, then you must issue a 1099 Misc form.

If the company checks the C or S Corporation or Trust/estate, you would not have to issue a 1099 form, UNLESS the company you paid is an attorney and you paid $600 or more for business-related services (not personal legal services).

If the company checks the C or S Corporation or Trust/estate, you would not have to issue a 1099 form, UNLESS the company you paid is an attorney and you paid $600 or more for business-related services (not personal legal services).

If you ask vendors to complete the W-9 when you begin doing business, it will save time at the end of the year filing a 1099 Misc, since you will already have the information.

Do we need to issue a 1099 to someone who earned less than $600?Answer: A company is not required to send a 1099 Misc to a vendor who was paid less than $600. There are sometimes when a company may still choose to send a 1099 for less. Legally, the vendor should still be reporting the income on their taxes, whether or not they received a 1099.

Do we need to correct a 1099 when the vendor notifies you their address has changed after you have sent them their 1099 Misc form?Answer: No, you do not have to go through the process of correcting the 1099 form just for an address change. The IRS tracks the forms by the Social Security/Federal ID number and name associated with the number. You should update your software records with the new address and you could give them an updated vendor copy with the new address for their records, but the IRS does not need to receive a corrected copy with the new address.

By: Sandra Stone, Accountant

Categories: Uncategorized

Tax Savings on Your Education

Mar 10, 2015

If you’re helping to pay for your child’s college education, you need a break. See if you can take advantage of any of the tax breaks that follow.

Take Credit There are two federal tax credits for the payment of qualified tuition and related expenses (not room and board). A tax credit is a big break because it reduces your income tax dollar-for-dollar. You can’t use both credits in the same year for the same student.

American Opportunity Tax Credit is available for the first four years of post-secondary education. The credit for 2015 is 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. So, the maximum credit for each eligible student in your family is $2,500.

Lifetime Learning Credit is available for both undergraduate and graduate education. The credit is 20% of up to $10,000 of qualified expenses per taxpayer return. So, the maximum credit you can claim in one year for all students in your family is $2,000. Both credits are subject to income restrictions.

Deduct Your Expenses A tax deduction reduces the income on which you’ll be taxed. If you’re eligible, you can claim a deduction for student loan interest even if you don’t itemize your deductions. Interest of up to $2,500 is deductible in 2015 if your income doesn’t exceed tax law limits. If you’ve taken a loan to pay for your child’s education, check into the requirements for the deduction — it’s a break you won’t want to miss.

Categories: Uncategorized