Frequent Asked Questions About Form 1099 Misc

Mar 17, 2015

Each year, I receive multiple questions during the first few months regarding issuing 1099 Misc forms. Many of the questions are general in nature. For example, “when are the forms due?” However, there are always some questions that are not a quick one or two-word answer.

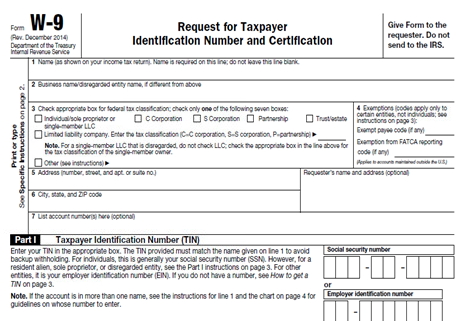

Do we need to send a 1099 Misc to a company if they are an LLC?Answer: It depends on how the LLC is being taxed by the IRS? The best way to find out is to ask the company to complete a Form W-9, or Request for Taxpayer ID number. In Box 3, if the vendor checks the first box Individual/Sole Proprietor or single member LLC or the Partnership box, then you must issue a 1099 Misc form.

If the company checks the C or S Corporation or Trust/estate, you would not have to issue a 1099 form, UNLESS the company you paid is an attorney and you paid $600 or more for business-related services (not personal legal services).

If the company checks the C or S Corporation or Trust/estate, you would not have to issue a 1099 form, UNLESS the company you paid is an attorney and you paid $600 or more for business-related services (not personal legal services).

If you ask vendors to complete the W-9 when you begin doing business, it will save time at the end of the year filing a 1099 Misc, since you will already have the information.

Do we need to issue a 1099 to someone who earned less than $600?Answer: A company is not required to send a 1099 Misc to a vendor who was paid less than $600. There are sometimes when a company may still choose to send a 1099 for less. Legally, the vendor should still be reporting the income on their taxes, whether or not they received a 1099.

Do we need to correct a 1099 when the vendor notifies you their address has changed after you have sent them their 1099 Misc form?Answer: No, you do not have to go through the process of correcting the 1099 form just for an address change. The IRS tracks the forms by the Social Security/Federal ID number and name associated with the number. You should update your software records with the new address and you could give them an updated vendor copy with the new address for their records, but the IRS does not need to receive a corrected copy with the new address.

By: Sandra Stone, Accountant

Categories: Uncategorized