Unemployment Insurance Benefits For Those Affected By COVID-19

Mar 18, 2020

The impact of COVID-19 around the United States is understandably worrisome. We’re providing this information to you regarding the latest news from the Trump administration and the State of Ohio’s unemployment benefits if you find that you have furlough all or some of your employees.

The administration also has announced this morning that the IRS will be deferring IRS payments from individuals and pass-through entities. If you owe a payment to the IRS, you can defer up to $1 million as an individual or pass-through entities and up to $10 million to corporations, interest-free and penalty-free, for 90 days.

The administration continues to work on the economic stimulus plan with Senators and House of Representatives, including loan guarantees, payments to small businesses, and payments to the American workers. After passage, they are hoping that checks to individuals can be made immediately – in the next 2 weeks.

Please rely on official sources, press conference details from national, state and local authorities, as we are, instead of media reports. We will do our best to summarize the guidelines for our clients as we understand that interpreting the messages from the CDC and Ohio Department of Health can be daunting. Besides official press conferences, our two main sources are:

- National Centers for Disease Control – Guidance for Businesses

- Ohio Business Gateway – Message to Employers

Unemployment Insurance Benefits

COVID-19 Pandemic Unemployment Payment is a new social welfare payment for employees and self-employed people who are unemployed or who have their hours of work reduced during the COVID-19 (coronavirus) pandemic. This includes people who have been put on part-time or casual work. You can apply for the payment if you are aged between 18 and 66 and have lost employment due to the coronavirus restrictions. Students can apply for the payment.

Here’s what we know as of this writing about Ohio’s unemployment insurance benefits for your employees:

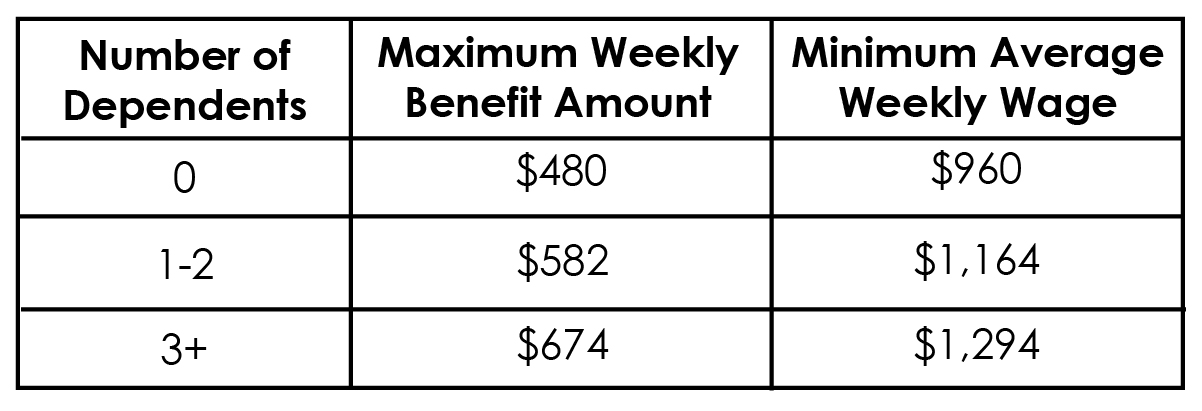

The weekly benefit amount is the amount of benefits employees may be entitled to receive for one week of total unemployment. Employees’ weekly benefit amount is computed at one-half of their average weekly wage during their base period (the base period is the 52 weeks prior to filing for unemployment). However, the weekly benefit amount cannot exceed the state’s annually established maximum levels (based on the number of allowable dependents claimed). The 2020 maximums for each dependency classification are given in the following table:

Example: $1200 average weekly wage X ½ = $600

Using this example, if an employee has 3 or more dependents, the weekly benefit amount would be $600 (as the maximum of $647 was not reached). However, if the employee had less than 3 dependents, the weekly benefit amount would be the maximum level allowable for fewer dependents (0 dependents = $480, while 1 or 2 dependents = $582).

NOTE: See below for information about deductible income and earnings which may reduce employee’s weekly benefit amount.

Employees must report all weekly income, including payments other than wages. In certain cases, the entire amount may be deducted from your benefits. Types of income that may be deductible include:

- Severance pay – Severance pay allocated by the employer to a week(s) following the date of separation is deductible from unemployment benefits.

- Vacation pay

- Pensions

- Company buy-out plans

- Workers’ Compensation

Employers can offer de minimis benefits (small amounts) like gift cards – generally under $75.

The waiting period of one week for unemployment benefits has been waived in Ohio. The Governor said employers will not be penalized for their employees filing for unemployment.

Filing for Unemployment Insurance Benefits

Ohio has two ways to file an application for Unemployment Insurance Benefits:

- Online – http://unemployment.ohio.gov – 24 hours/day, 7 days/week. Service may be limited during nightly system updating.

- Telephone – Call toll-free 1-877-644-6562 Monday through Friday 8 AM – 5 PM.

To apply for Unemployment Insurance Benefits, employees will need:

- Social Security number

- Driver’s license or state ID number

- Name, address, telephone number, and e-mail address

- Name, address, telephone number, and dates of employment with each employer worked for during the past 6 weeks of employment

- The reason why the worker has become unemployed from each employer

- Dependents’ names, Social Security numbers, and dates of birth

- If claiming dependents, their spouse’s name, Social Security number, and birth date

- Regular occupation and job skills – but employees will not have to actively search for jobs during this period.

- For your business and healthcare practices, there may be tax savings, low-interest loans through the SBA if other credit financing options are NOT available. The stimulus package being discussed is for individuals and certain small businesses under 500 employees.

Other Important Considerations

Business Interruption Insurance – Most businesses have, or should have business interruption insurance. You are urged to check with your business insurance broker to see if you have such coverage, determine if this qualifies, and what you need to do to receive reimbursement from your insurance company for your loss of business income. Up-to-date financial and payroll information will be critical.

Employment for dental workers – Healthcare workers are needed everywhere and it’s possible employees trained in HIPAA and other health safety precautions may be able to find work elsewhere. (Some requirements for HIPAA requirements have been waived for telehealth options.) Also, hospitals and medical centers are looking to dental offices to share the number of masks, gloves, etc., they have on hand.

As always, please call your William Vaughan Company advisor with any questions.

Categories: Other Resources

Gift-giving and Taxes

May 25, 2017

The recipient of a gift need not worry about the tax consequences; receipts of gifts are non-taxable events. However, that is not always the case for the giver. Every year the IRS allows for the tax-free transfer of a specified amount of monetary gifts. For 2017 this amount stands at $14,000 per person, per year. Amounts given to any one individual, by any one individual, during a tax yearbring about no consequences as long as they are at or below $14,000. For example, a husband and wife can each give $14,000 in cash ($28,000 total) to each of their grand-kids every year, with no resulting tax or return filing consequences.

The recipient of a gift need not worry about the tax consequences; receipts of gifts are non-taxable events. However, that is not always the case for the giver. Every year the IRS allows for the tax-free transfer of a specified amount of monetary gifts. For 2017 this amount stands at $14,000 per person, per year. Amounts given to any one individual, by any one individual, during a tax yearbring about no consequences as long as they are at or below $14,000. For example, a husband and wife can each give $14,000 in cash ($28,000 total) to each of their grand-kids every year, with no resulting tax or return filing consequences.

Gifts in excess of this annual exclusion can also be tax-free; however, these gifts are required to be reported against the givers lifetime gift and estate exemption. The total lifetime exemption for 2017 stands at $5.49 million per individual. Gifts made during the year in excess of the annual exclusion ($14,000) require the giver to file a gift tax return. This return discloses the excess gifts given annually as well as tracking their lifetime excess/remaining exclusion. Typically annual gift returns come with no tax due; however, these returns reduce the tax-free amount allowed upon death and could have potential tax consequences down the road.

Bottom line? If you have a large estate and make any large gifts during the year, consult your tax advisor. We may be able to offer advice on how to better structure these transactions.

– Courtney Elgin, CPA

Categories: Other Resources, Tax Compliance, Tax Planning

Planning Ahead for Retirement

May 22, 2017

Transferring Your Retirement Savings?

When moving around your retirement savings, it is always best to have a plan. There are several options available to you when changing a job or just changing your retirement plan.

- Lump sum withdraws from your 401(k) from your old employer. Generally, this option is not advisable unless, in dire need of cash, as it can considerably reduce your retirement savings. Also, this could end up boosting you up into a higher tax bracket. Either way, you’ll end up paying more taxes.

- Leave the money in your old employer’s 401(k) plan. Generally, once you reach retirement age, your former employer may require you to withdraw the balance. The balance may also be left in the old plan temporarily while you look into new plans and find the right one for you. Unfortunately this not always an option. If your vested balance is $5,000 or less, your old employer may require you to take it out upon leaving the company.

- You can choose to have your balance transferred directly to your new plan, if allowed, through your financial institution. This is generally the best decision as the savings go on without any disruption or withholdings.

- Another option, within the transfer option, is to have a check made out to you for the amount and then to deposit the check into your new employer’s plan or an alternate IRA. When using this option, you should be aware of the implications that come along with it, primarily the 60 day window that you must transfer the deposit within. Not doing so can have hefty tax consequences. The full amount will be taxable and if you are under the age of 59 and a half then you will be subject to a 10% penalty. Generally, taxpayers do not knowingly miss the 60 day window and have unwillingly faced financial burdens as a result. Because of this the IRS has cut taxpayers a break and provided a set of rules designed to offer relief from penalties.

Basic Qualifying Factors:

- An error was committed by the financial institution receiving the contribution or

- making the distribution to which the contribution relates;

- The distribution, having been made in the form of a check, was misplaced and

- never cashed;

- The distribution was deposited into and remained in an account that the

- taxpayer mistakenly thought was an eligible retirement plan;

- The taxpayer’s principal residence was severely damaged;

- A member of the taxpayer’s family died;

- The taxpayer or a member of the taxpayer’s family was seriously ill;

- The taxpayer was incarcerated;

- Restrictions were imposed by a foreign country;

- A postal error occurred;

Myriad options exist when rolling your retirement plan assets, including utilizing these new rules in the event an inadvertent violation of the 60-day rollover provision occurs.

Contact your William Vaughan Company advisor for more information and to discuss these rules in depth.

– Matthew J. Babcock, Staff Accountant

Categories: Audit & Accounting, Other Resources

Home Sweet Office

May 10, 2017

Do you have a room in your home that you use just for your business? If so, you could claim a deduction on your tax return for your home office.

Before we get ahead of ourselves, we should acknowledge that you will have to meet certain requirements. However, most are able to deduct a percentage of the costs of running the home such as utilities, rent, insurance, depreciation, mortgage interest, real estate taxes, some casualty losses, repairs, and improvements as related to the portion of your home used for business.

A “home”, as defined by the IRS, can be a condo, house, apartment, mobile home or boat (with provided amenities). The home can be rented or owned, however, to qualify for the home office deduction you must meet two tax law requirements:

- You must regularly use part of your home exclusively for a trade or business.

- You must be able to show that you use your home as your principal place of business meaning you meet patients, clients, or customers at your home or you use a separate structure on your property exclusively for business purposes.

Regular use:

The IRS doesn’t offer a clear definition of regular use – only that you must use a part of your home for business on a continuing basis, not just for occasional or incidental business. You should qualify by working a couple days a week for a few hours.

Exclusive use:

Exclusive means that you must use a portion of your home only for your business. If you use a portion of your home for work but also for personal use then you will not meet that requirement. However, you are able to use a portion of a larger room as long as your personal activities do not enter that area. There are two exceptions to the exclusive use rule. If you run a qualified daycare out of your home or store inventory or product samples then you do not have to meet the exclusive use test.

If you are storing inventory or samples in your home, you can still qualify for the home business expense even if you are not using that space exclusive for your business.The inventory will need to be stored in a certain location such as the garage, a closet, or bedroom. However, you will not get the deduction if you have an office or business location outside of your home.

Remember you can only claim this deduction if you are running a business. If the IRS believes it’s a hobby the deduction will not be honored.

– Brittany Jennings, Staff Accountant

Categories: Audit & Accounting, Other Resources, Tax Compliance, Tax Planning

Looking to Sell?

Aug 04, 2016

Are you looking to sell your business? Maybe you’re considering retirement, in poor health, or just ready to cash in. Whatever your reason, you should be aware of the complexity of your venture, as well as the tax consequences that come along with it. The very first step should always be consulting with your WVC adviser. You can obtain an accurate business valuation and develop a tax planning strategy to minimize capital gains, and any other taxes from the sale, to maximize your profits.

Are you looking to sell your business? Maybe you’re considering retirement, in poor health, or just ready to cash in. Whatever your reason, you should be aware of the complexity of your venture, as well as the tax consequences that come along with it. The very first step should always be consulting with your WVC adviser. You can obtain an accurate business valuation and develop a tax planning strategy to minimize capital gains, and any other taxes from the sale, to maximize your profits.

Most business owners do not know how much their business is worth. This can result in severely under or overestimating a proper selling price. Obtaining a third party business valuation allows owners to sell at a price that is realistic for potential buyers, while maximizing the total value and profit at the same time.

As a business owner, you may think of your business as a single entity sold for one lump sum. However, it is actually a combination of assets to be sold that will be subject to different taxes under federal and state laws. The IRS requires each asset to be classified as capital assets, depreciable property used in the business, real property used in the business, goodwill or property held for sale to customers. The gain or loss on each asset is figured separately, classified as capital or ordinary, and taxed accordingly.

The sale of depreciable property can be tricky. Section 1231 gains and losses are the taxable gains and losses from the sale or exchange of real or depreciable property held for longer than one year. Whether you have a net gain or loss from all 1231 transactions determines if they will be treated as ordinary or capital. When section 1245 or 1250 property is sold at a gain, you may have to recognize all or part of the gain as ordinary income due to depreciation recapture rules. The remaining gain would be considered a 1231 gain.

The way a business is taxed when sold also depends on the business structure. “Pass-through” entities such as sole proprietorship, partnerships, and limited liability companies are required to sell each asset separately. This provides much more flexibility when structuring a sale to benefit both the buyer and seller with regard to tax consequences.

Corporations and s-corporations are subject to more complex regulations when selling assets and stock. For example, when a corporation is sold, the seller is taxed twice for all assets. The corporation pays any gains tax when the assets are sold, and the shareholders pay capital gains tax when the corporation is dissolved. On the other hand, s-corporations are only taxed once. Income or loss flows through to the shareholders who then report it on their individual tax returns.

Are you thinking of selling your business soon? Our team of business valuation and tax planning experts can help you make the most money with the least amount of consequence.

-Halie N. Baker, Staff Accountant

Categories: Other Resources