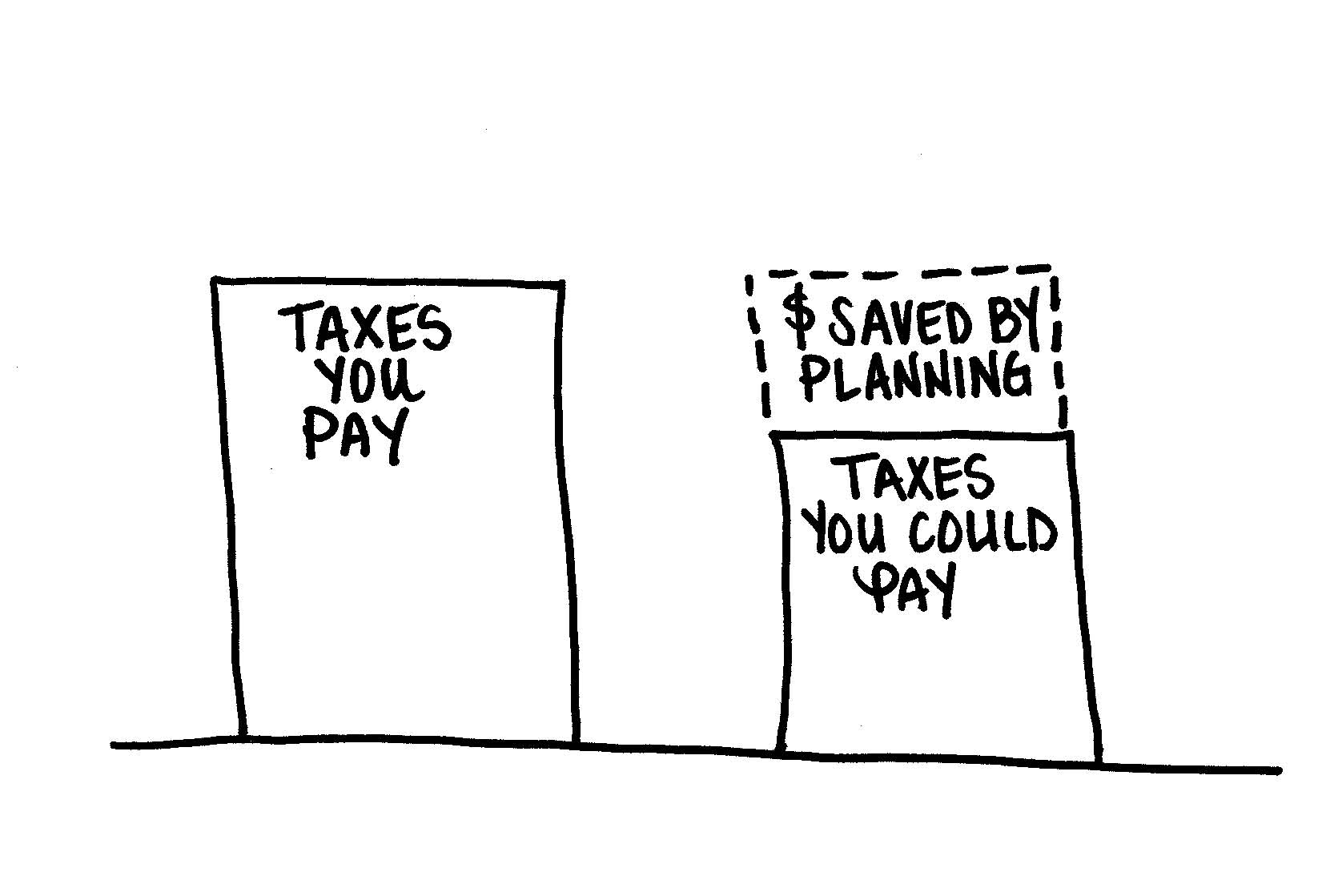

Tax Planning & Trimming Your Tax Bill

Oct 29, 2014

When it comes to making moves to slash your federal income-tax bill, it pays to start early. You have a limited opportunity to come up with planning strategies that may help reduce the taxes you’ll owe for 2014, so don’t miss out.

Can You Say Loss?

While you haven’t actually lost anything until you sell an underperforming investment, now may be a good time to review your portfolio for potential candidates. An investment that has lost value since you acquired it and consistently underperformed its benchmark may no longer belong in your portfolio. If the investment shows no sign of improving, selling it before year-end and taking a capital loss may be your best move. Capital losses are fully deductible to offset capital gains and up to $3,000 of ordinary income each year ($1,500 if married filing separately). Excess losses can be carried over for deduction in future years, subject to the same limitations.

A Good Time for Gains

Favorable tax rates may make taking profits on appreciated stock you’ve held longer than one year advantageous. Long-term capital gains from the sale of stocks and other securities are currently taxed at a maximum rate of 15% for most taxpayers, 0% for taxpayers in brackets below 25%, and 20% for taxpayers in the top regular tax bracket (39.6%). Current capital losses or carryover losses from a prior year can offset gains from the sale.

Don’t make taxes your only reason for selling an investment. Consider the impact the sale will have on your overall portfolio before you make a decision.

Increasing your pretax contribution to an employer-sponsored retirement plan before the end of the year may be another strategy to consider. Since you don’t pay current taxes on your contributions, deferring a greater amount of your pay can lower your tax bill. If you’ve reached age 50 and already contributed the maximum annual amount through salary deferrals, your plan may allow you to make catch-up contributions.

In addition, the contributions you make to a traditional individual retirement account by April 15, 2015, may be deductible on your 2014 tax return. The 2014 contribution limit is $5,500 ($6,500 if you’re age 50 or older). Your tax advisor can review the deduction requirements with you.

Donating to Charity

You have until year-end to make donations to your favorite organizations and claim an itemized deduction for charitable contributions. (Make sure the organizations qualify to receive deductible contributions.) By donating with a credit card or with a check mailed by December 31, you’ll be able to take the deduction on your 2014 return even though you won’t receive your credit card bill or have your check processed until January 2015. You’ll need to have specific proof of your gifts. Deduction limits apply.

Bunching Expenses

Accelerating or delaying expenses is a strategy that may help you exceed the floor amounts for certain deductions. For 2014, medical expenses are deductible only in the amount that exceeds 10% of adjusted gross income, or AGI (7.5% of AGI for individuals age 65 or older). Scheduling and paying out-of-pocket costs before year-end for medical appointments, elective surgery, dental work, or eye exams that you were planning for early 2015 may help you exceed the floor. The deduction for unreimbursed employee business and miscellaneous expenses is limited to the amount that exceeds 2% of AGI.

Not every strategy mentioned will be appropriate for your personal situation. Your tax advisor can help you determine those that can make a difference.

Categories: Uncategorized