$1.9 trillion American Rescue Plan Relief Bill Signed Into Law

Mar 11, 2021

Today, President Biden signed into law the American Rescue Plan, a $1.9 trillion stimulus package that allocates federal funding to a variety of matters, including aid for vaccinations and testing, state and local governments, schools, rental assistance, restaurants, and the airline industry. It also includes several tax-related provisions and additional business relief.

Here are some of the key individuals and businesses provisions:

Individuals

Stimulus Checks – Funding has been allocated for a third round of stimulus checks. Notable changes include the income cutoff at which payments phase out from $100,000 to $80,000 for individuals and $200,000 to $160,000 for couples filing jointly. Those who qualify will receive the full direct payment of $1,400 per person. Individuals will also receive an additional $1,400 payment for each dependent claimed on their tax returns. Dependents over the age of 17 and qualifying relatives who are claimed as dependents also now qualify.

Unemployment Benefits – Unemployment benefits previously set to expire on March 14 have now been extended almost 6 months to September 6, 2021. In addition, recipients will receive an extra $300 per week through the fall deadline along with making the first $10,200 of benefit payment nontaxable for households with incomed below $150,000. The 10,200 exclusion only applies to benefits received last year, 2020.

Child Tax Credit – A temporary expansion of the existing child tax credit with significant adjustments including those noted below.

- 17-year-old- children are now able to qualify.

- Increase of the credit to $3,000 per child ages 6 to 17 or $3,600 per child under the age of 6

- Removal of the $2,500 earning floor

- Credit is now fully refundable

- A 50% credit advancement by the IRS paid in periodic payment from July 2021 to December 2021

Low-Income Support – In an effort to target low-income families afflicted by the pandemic, $4.5 billion has been set aside for the Low Income Home Energy Assistance Program, or LIHEAP, to help families with home heating and cooling costs.

Businesses

Employee Retention Tax Credit (ERTC) – The expanded ERTC provisions under the Consolidated Appropriations Act (CAA) were set to expire on July 1 which has now been extended through December 31, 2021, for eligible employers. In addition, eligibility has been expanded to include start-up businesses established after February 15, 2020, with annual gross receipts of up to $1 million.

Paycheck Protection Program (PPP) – Provides an additional $7.25 billion for the Paycheck Protection Program (PPP) and expands eligibility to include nonprofit entities. Importantly, eligible nonprofit organizations would now qualify for a PPP loan as long as they employ not more than 500 employees per physical location (300 per physical location for Second Draw loans) and meet all other criteria.

Economic Injury Disaster Loan (EIDL) – The new law also includes an additional $15 billion in funding for targeted EIDL advances. One-third of this EIDL funding is earmarked for businesses that suffered a revenue loss of greater than 50 percent and employ fewer than 10 people.

Families First Coronavirus Response Act (FFCRA) Paid Leave Credits – The new law also extends these tax credit provisions through September 30, 2021. However, adjustments have been made for wages paid between April 1, 2021, and September 30, 2021, including increasing eligible wages to $12,000 per employee (up from $10,000 in 2020), expanding types of leave to include vaccination, and covering as many as 60 days of paid family leave for self-employed individuals (instead of 50 days under previous law).

Industry-Specific Funding

- Restaurants – A $25 billion Restaurant Revitalization Fund has been established for 2021. Grant amounts will be limited to a restaurant’s pandemic-related revenue loss (measured as the difference in gross receipts in 2020 compared to 2019) up to $10 million and limited to $5 million per physical location. For more details on this U.S. Small Business Administration (SBA) administered program, check out our blog.

Categories: COVID-19

Unemployment Insurance Benefits For Those Affected By COVID-19

Mar 18, 2020

The impact of COVID-19 around the United States is understandably worrisome. We’re providing this information to you regarding the latest news from the Trump administration and the State of Ohio’s unemployment benefits if you find that you have furlough all or some of your employees.

The administration also has announced this morning that the IRS will be deferring IRS payments from individuals and pass-through entities. If you owe a payment to the IRS, you can defer up to $1 million as an individual or pass-through entities and up to $10 million to corporations, interest-free and penalty-free, for 90 days.

The administration continues to work on the economic stimulus plan with Senators and House of Representatives, including loan guarantees, payments to small businesses, and payments to the American workers. After passage, they are hoping that checks to individuals can be made immediately – in the next 2 weeks.

Please rely on official sources, press conference details from national, state and local authorities, as we are, instead of media reports. We will do our best to summarize the guidelines for our clients as we understand that interpreting the messages from the CDC and Ohio Department of Health can be daunting. Besides official press conferences, our two main sources are:

- National Centers for Disease Control – Guidance for Businesses

- Ohio Business Gateway – Message to Employers

Unemployment Insurance Benefits

COVID-19 Pandemic Unemployment Payment is a new social welfare payment for employees and self-employed people who are unemployed or who have their hours of work reduced during the COVID-19 (coronavirus) pandemic. This includes people who have been put on part-time or casual work. You can apply for the payment if you are aged between 18 and 66 and have lost employment due to the coronavirus restrictions. Students can apply for the payment.

Here’s what we know as of this writing about Ohio’s unemployment insurance benefits for your employees:

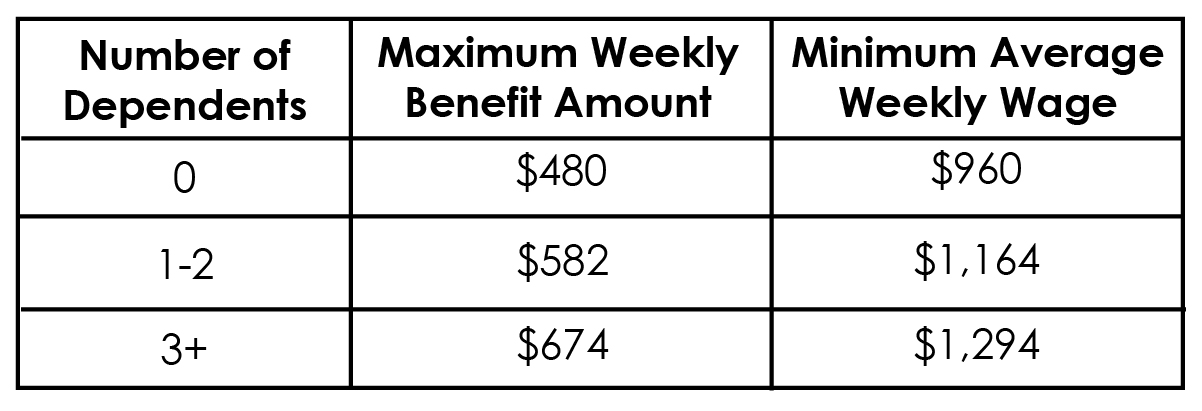

The weekly benefit amount is the amount of benefits employees may be entitled to receive for one week of total unemployment. Employees’ weekly benefit amount is computed at one-half of their average weekly wage during their base period (the base period is the 52 weeks prior to filing for unemployment). However, the weekly benefit amount cannot exceed the state’s annually established maximum levels (based on the number of allowable dependents claimed). The 2020 maximums for each dependency classification are given in the following table:

Example: $1200 average weekly wage X ½ = $600

Using this example, if an employee has 3 or more dependents, the weekly benefit amount would be $600 (as the maximum of $647 was not reached). However, if the employee had less than 3 dependents, the weekly benefit amount would be the maximum level allowable for fewer dependents (0 dependents = $480, while 1 or 2 dependents = $582).

NOTE: See below for information about deductible income and earnings which may reduce employee’s weekly benefit amount.

Employees must report all weekly income, including payments other than wages. In certain cases, the entire amount may be deducted from your benefits. Types of income that may be deductible include:

- Severance pay – Severance pay allocated by the employer to a week(s) following the date of separation is deductible from unemployment benefits.

- Vacation pay

- Pensions

- Company buy-out plans

- Workers’ Compensation

Employers can offer de minimis benefits (small amounts) like gift cards – generally under $75.

The waiting period of one week for unemployment benefits has been waived in Ohio. The Governor said employers will not be penalized for their employees filing for unemployment.

Filing for Unemployment Insurance Benefits

Ohio has two ways to file an application for Unemployment Insurance Benefits:

- Online – http://unemployment.ohio.gov – 24 hours/day, 7 days/week. Service may be limited during nightly system updating.

- Telephone – Call toll-free 1-877-644-6562 Monday through Friday 8 AM – 5 PM.

To apply for Unemployment Insurance Benefits, employees will need:

- Social Security number

- Driver’s license or state ID number

- Name, address, telephone number, and e-mail address

- Name, address, telephone number, and dates of employment with each employer worked for during the past 6 weeks of employment

- The reason why the worker has become unemployed from each employer

- Dependents’ names, Social Security numbers, and dates of birth

- If claiming dependents, their spouse’s name, Social Security number, and birth date

- Regular occupation and job skills – but employees will not have to actively search for jobs during this period.

- For your business and healthcare practices, there may be tax savings, low-interest loans through the SBA if other credit financing options are NOT available. The stimulus package being discussed is for individuals and certain small businesses under 500 employees.

Other Important Considerations

Business Interruption Insurance – Most businesses have, or should have business interruption insurance. You are urged to check with your business insurance broker to see if you have such coverage, determine if this qualifies, and what you need to do to receive reimbursement from your insurance company for your loss of business income. Up-to-date financial and payroll information will be critical.

Employment for dental workers – Healthcare workers are needed everywhere and it’s possible employees trained in HIPAA and other health safety precautions may be able to find work elsewhere. (Some requirements for HIPAA requirements have been waived for telehealth options.) Also, hospitals and medical centers are looking to dental offices to share the number of masks, gloves, etc., they have on hand.

As always, please call your William Vaughan Company advisor with any questions.

Categories: Other Resources