Employee Retention Tax Credit Expanded Under CAA

Jan 06, 2021

Prior to the passage of the Consolidated Appropriations Act, 2021, (CAA), the Employee Retention Tax Credit (ERTC) was as afterthought reserved to the deepest recesses of most employers’ minds as in the original CARES Act, taking a PPP loan and requesting subsequent forgiveness of that loan precluded businesses from also taking the ERTC. At best, the ERTC was a backup option for businesses that failed to request a PPP loan on time or had too many employees for the PPP loan. Now, however, with the passage of the Consolidated Appropriations Act, 2021 just days ago, the ERTC is retroactively available to employers even if they took a PPP loan.

The ERTC is a refundable payroll tax credit that can be taken against employment taxes equal to 50 percent of the qualified wages an employer pays to employees after March 12, 2020, and through December 31, 2020.

This post dives into the details of the ERTC and the mechanics of how employers can capitalize on this additional benefit.

The ERTC for 2020

As noted above, employers that borrowed a PPP loan can now also claim the ERTC for 2020 but not on the same dollars of payroll costs. What this means is wages and health care costs used in calculating the ERTC cannot also be used in deriving PPP loan forgiveness. Simply put, there’s no double-dipping. In order the qualify for the ERTC an employer must satisfy one of the following conditions:

- Full or partial suspension of business operations during any calendar quarter due to government orders limiting commerce, travel, or group meetings as a result of COVID-19 (this does not include individuals business choices or simple advisories by public officials), OR

- A significant (>50%) decline in gross receipts in a 2020 calendar quarter in relation to the same quarter in 2019.

If the significant gross receipts decline qualification is met, every quarter thereafter is considered a qualifying quarter until the first day of a calendar quarter following a quarter in which gross receipts returned to at least 80% of the gross receipts in the same quarter during 2019.

Example: Gross receipts for 2020 are $100,000, $150,000, $100,000, and $120,000 for Q1, Q2, Q3, and Q4 of 2019 respectively. Gross receipts are $45,000, $112,500, $83,000, and $90,000 for Q1, Q2, Q3, and Q4 of 2020 respectively. The employer would qualify for the ERTC beginning in quarter one since gross receipts decreased 55%. Quarter four would not be a qualified quarter since gross receipts rose back to 83% of the prior year’s receipts during the 3rd quarter.

If a business began in the middle of a quarter, gross receipts would be extrapolated to estimate the total quarter’s receipts. For example, if a business began on June 1st and reported $50,000 in gross receipts for the month, the business would use $150,000 of gross receipts for the 2nd quarter of 2019 ($50,000 x 3 months). Extrapolated gross receipts would be used for any prior quarter in 2019.

Once an employer has determined they qualify under one of the stipulations above, the next step is to determine on which wages to calculate the credit. First, in the event that a business is fully or partially suspended, only wages paid during the period of suspension can be used in calculating the ERTC. If the business qualifies based on the gross receipts test, the wages from each qualifying quarter can be used. The number of average monthly full-time employees (FTEs) significantly affects what wages can be used under either qualifying event. If the employer had less than or equal to 100 average monthly (FTEs) in 2019, then all wages paid to all employees during the eligible time period can give rise to a credit. If however, the employer had greater than 100 average monthly FTEs in 2019, only wages paid to employees during the eligible time period to NOT WORK are eligible for the credit. For purposes of this rule, and FTE is an employee who, for any calendar month in 2019, had an average of at least 30 hours of service per week or 130 for the month. This is not a fractional calculation. All employees working less than 30 hours count as zero FTEs in the average monthly calculation.

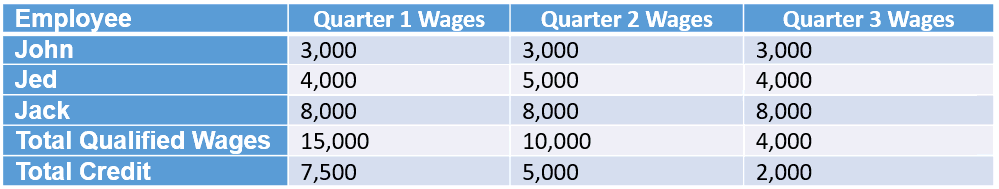

After considering all of the qualifications, the calculation of the credit is pretty straightforward. The ERTC is 50% of up to $10,000 of wages, including certain health insurance costs per employee per year. Let’s look at a simple example.

As seen in the table above, Jed’s quarter 3 wages are limited to $1,000 since $9,000 of his wages were already accumulated in quarters 1 and 2. Likewise, Jack’s wages are limited beginning in the second quarter and none of his wages are eligible in quarter 3.

One caveat to keep in mind when running the numbers on this credit is that wages up to the amount of the credit are not allowed as a deduction on the employer’s income tax return. So if an employer claims a $5,000 credit on $10,000 of wages, $5,000 of those wages are non-deductible for tax purposes.

As for businesses with multiple entities or subsidiaries, the following aggregation rules apply:

- if ONE business in the group has been partially or fully suspended, then all businesses in the group are considered to have been partially or fully suspended

- when calculating the percentage decline in gross receipts quarter over quarter, the gross receipts of ALL aggregated businesses must be taken into account

- when determining FTEs for purposes of the 100 FTE threshold, employees from all of the businesses in the group must be added together

Finally, in order to claim this credit, the employer can use one of two approaches. First, employers will report their total qualified wages and related health insurance costs for each quarter on their quarterly payroll tax returns (Form 941 for most employers). The credit is then taken against amounts that would have otherwise been deposited including federal income tax withheld, the employer’s share of Social Security and Medicare tax, and the employees’ share of Social Security and Medicare tax. The second acceptable method is to request an advance of the ERTC by submitting Form 7200.

OK – intermission. Stand up, stretch, use the restroom, and refill your coffee. We made it through the 2020 provisions of the Employee Retention Tax Credit. Next, we are going to breeze through the extension of the ERTC into 2021 provided by the Consolidated Appropriations Act, 2021. Here we go…

Changes for the 2021 ERTC Program

Congress voted to extend the ERTC into 2021 with the program set to end on June 30, 2021. The credit percentage has been increased from 50% to 70% and it is now calculated on $10,000 of wages per employee per quarter. In addition, the FTE threshold is up to 500 FTEs vs. 100 in 2020 and, what is considered a significant reduction in gross receipts quarter over quarter is down from greater than 50% to greater than 20%. Furthermore, congress tossed up a softball by including the provision that, when considering gross receipts for the first quarter of 2021, the employer can elect to compare Q4 of 2020 vs. Q4 of 2019 instead of Q1 of 2021 vs. Q1 of 2019 in the event that there’s a benefit to doing so.

One additional rule put in place for 2021 is that the advance credit claimed via Form 7200 cannot exceed 70% of the average quarterly wages paid in 2019.

As can be expected, the various allocations and calculations possible under the multitude of possible scenarios are far too comprehensive to include in the overview of this blog. When considering the ERTC for your business, do not hesitate to reach out to a William Vaughan adviser for assistance on maximizing the benefits of this program.

By: Jon Floering, CPA

Categories: COVID-19, Tax Planning

PPP Forgiveness Simplified

Dec 15, 2020

The plethora of reporting requirements created by the PPP loan forgiveness process has left many pulling their hair out trying to assemble the necessary documentation. For some, this is an unfortunate reality. However, for those with smaller PPP loans or relatively straight-forward qualifying expenses, the extra stress may be avoidable. Before spending hours tearing apart your company records, review the considerations below to identify if you are eligible for a more streamlined application process.

#1. If you obtained a loan of $50,000 or less, you are eligible to use forgiveness application Form 3508S which requires fewer calculations and less documentation for borrowers. Borrowers using this form are exempt from reductions in loan forgiveness due to Full-Time Equivalent (FTE) employee reductions and/or salaries and wages. There is also no requirement to show calculations used to determine loan forgiveness amounts. Please use the following links to access the form and instructions.

*There are currently discussions in Congress to implement a similarly streamlined application process for loans up to $150,000. Until a decision on this is made, we generally advise holding off on submitting forgiveness applications if your loan amount falls between $50,000 and $150,000

#2. See if you qualify for the 3508EZ loan forgiveness application – A brief, high-level summary of qualifications is as follows:

- the borrower is self-employed with no wages at the time of PPP application, OR

- the borrow did not reduce wages more than 25% during the covered period AND did not reduce the number of employees or average paid hours between January 1, 2020, and end of the covered period, OR

- the borrow did not reduce wages more than 25% during the covered period AND was unable to operate during the covered period at pre-COVID levels of business activity due to compliance with established governmental requirements.

Please see the following links for more in-depth detail on these qualifications as well as exceptions.

#3. When gathering supporting documentation for your loan forgiveness application, it may not be necessary to gather ALL of the applicable expense information. For example, for a loan amount of $200,000, compile enough expenses to cover that $200,000 with some cushion to account for any unforeseen disallowance, i.e., submit and document around $220,000-$240,000 of expenses although you may have actually spent $500,000 of eligible expenses during your covered period. Additionally, if loan forgiveness will be covered with entirely payroll expenses, something as simple as a report for the covered period from your third-party payroll provider should be sufficient from a documentation standpoint

#4. Lastly, please keep in mind that if your business qualifies for the §199A qualified business income (QBI) deduction and/or the tax credit for research and development (R&D) expenses, there are certain caveats to consider when using payroll expenses for qualified loan forgiveness. Absent relevant guidance, use of these types of expenses could result in a reduction of said expenses available to be allocated toward QBI and R&D.

Please consult your WVC adviser to further evaluate the most beneficial allocation and use of qualified expenses for PPP loan forgiveness. We also encourage you to check-out our PPP Roadmap here.

By: Jon Floering, CPA

Categories: COVID-19

SBA Issues Loan Necessity Questionnaire

Nov 03, 2020

The Small Business Administration (SBA) has issued new loan necessity questionnaires which all businesses with PPP loans greater than $2 million will be required to complete. These questionnaires are intended to help the SBA determine whether the Borrower’s certification of economic uncertainty made the loan request necessary to support ongoing operations was appropriate. SBA has developed two distinct versions of the loan necessity questionnaire: one for for-profit borrowers, and one for non-profit borrowers.

- Form 3509 Loan Necessity Questionnaire (For-Profit Borrowers)

- Form 3510 Loan Necessity Questionnaire (Non-Profit Borrower)

To refresh, during the initial PPP Loan application, borrowers had to certify that “current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant.” However, at no point did the SBA provide any material guidance as to what this certification meant, leaving many borrowers anxious. The limited guidance during the loan application phase only stated borrowers must take into account their current business activity and their ability to access other sources of liquidity.

Please note, at this time these forms are not available on the SBA or Treasury website. It is anticipated these questionnaires will come directly from the lender and/or servicer. Lenders who have submitted loan forgiveness on behalf of impacted borrowers will receive a request from the SBA for completion of the form. While the instructions indicate the receipt of the questionnaire does not necessarily mean the SBA is challenging the good-faith certification, impacted borrowers are required to submit the completed forms within 10 business days of receipt from the lender.

Given the short turn-around time, we recommend that all borrowers with aggregated PPP loans of $2 million or more familiarize themselves with these forms now, and begin to gather related documentation

We encourage impacted PPP borrowers to reach out to their WVC advisor for assistance with the completion of the form, as detailed financial information is required.

Categories: COVID-19

Additional PPP Loan Guidance Issued

Oct 12, 2020

The last week-and-a-half saw a flurry of new Paycheck Protection Program (PPP) guidance. Here is an update on what changes were made:

A Streamlined process for loans of $50,000 or less

While this change does not go as far as was originally proposed – providing automatic forgiveness for loans up to $150,000 – it will still help a significant number of Borrowers. A new forgiveness application, Form 3508S, has been released for loans of $50,000 or less.

While forgiveness is still not automatic for these Borrowers, the confusing and administratively burdensome portions have been removed. These Borrowers do not need to compute or reduce their forgiveness amount by 1.) reductions in compensation or 2.) full-time equivalent employees. The result? Borrowers of loans of $50,000 or less will not be penalized for any reductions in wages or employees.

For those who are keeping track, there are now three different application forms for forgiveness:

- Form 3508 – Standard form for those who do not meet criteria for one of the other forms (form instructions here)

- Form 3508EZ – Can be used for loans of any size where there is no reduction in wages or full-time equivalent employees (with certain exceptions) (Form instructions here)

- Form 3508S – For all loans $50,000 and under regardless of any reductions in wages or full-time equivalent employees (form instructions here)

PPP and sales of businesses

Guidance related to the requirements of Borrowers who are selling their business or business assets was also released. For most cases of sales of businesses or business assets, the Borrower will need to complete the following before the closing of the sale:

- Notify their PPP lender of the planned transaction and provide copies of the proposed agreements

- Submit their forgiveness application along with all required supporting documentation

- Deposit funds in the amount of outstanding PPP loan balance into an escrow account with their PPP lender

Also, in certain cases, the SBA must approve the proposed transaction before it is executed.

10-month deferral period

When the PPP was created, payments on the loan were deferred for six months. This deferral period was later extended to 10 months from the end of the Borrower’s covered period. The latest guidance clarifies that loan documents executed prior to the extension to the 10-month deferral are automatically modified to the 10-month deferral and do not need to be re-written and re-signed.

What changes might still be coming to the PPP?

We could still see a change with respect to the tax-deductibility of expenses related to forgiveness. Currently, such expenses are not tax-deductible, and therefore create a taxable event.

There continues to be support for a second PPP. Most recently, Federal Reserve Chairman Jerome Powell commented on the need for additional support for small businesses. A second round of stimulus would likely be much more targeted.

If you have questions about how these new changes may impact your business, please reach out to your WVC Advisor or our WVC PPP Loan Task Force leader, Kate Matz at kate.matz@wvco.com or 419.891.1040.

Categories: COVID-19, Other Resources

Update on the State of the PPP

Oct 01, 2020

As the pace of changes to the Paycheck Protection Program (PPP) has relaxed, many are wondering about the current status and potential changes yet to come. We wanted to share with you some of the discussions occurring at the federal level about possible next steps. While there appears to be strong bipartisan support for these additional actions in concept, the specific details will likely change throughout the process.

What is the status of PPP and forgiveness?

- $525 billion was lent to 5.2 million businesses.

- Most lenders are now accepting forgiveness applications.

- As of 9/24, the SBA had received 96k forgiveness applications but had not completed the processing of any of them.

What is the latest guidance related to PPP forgiveness?

On 8/24, additional guidance was released regarding the following:

- C or S Corporation owners with less than 5% ownership are not subject to the compensation caps

- Expenses attributable to a tenant are not eligible for forgiveness.

- Rent payments to a related party are capped at the amount of mortgage interest owed on the property.

- Related party mortgage interest is not eligible for forgiveness.

What changes might still be coming to the PPP?

- There continues to be bipartisan support in Congress for blanket forgiveness of “small” loans – typically discussed as $150,000. The exact terms and dollar amount still need to be negotiated.

- There continues to be some bipartisan support for tax-deductibility of expenses related to forgiveness.

- Congress has been slow to act, and it is likely we will not see movement on these items until after the election.

Will there be a second PPP?

Maybe. Again, this is a topic that Congress continues to discuss. Eligible businesses would likely be much more targeted in this round. We are likely to see a lower cap on the size of business (as measured by the number of employees) and it is likely that businesses will need to demonstrate they have been significantly negatively impacted.

What should I be doing now?

- Continue to monitor our WVC COVID-19 Resource Center.

- Calculate your loan forgiveness amount using a tool such as our forgiveness calculator.

- Understand your lender’s process and timeline for forgiveness applications.

- In most cases, it makes sense to sit tight and wait for the final changes to work their way through Congress. Your forgiveness application is due 10 months after the end of your Covered Period, so you have time.

- Reach out to your WVC Advisor or our WVC PPP Loan Task Force leader, Kate Matz to discuss the above and plan for your specific situation.

Connect with the author:

Kate Matz, CPA, CEPA, CVGA, CGMA

Kate Matz, CPA, CEPA, CVGA, CGMA

Value Growth Practice Leader, William Vaughan Company

kate.matz@wvco.com | 419.891.1040

Categories: COVID-19, Other Resources