Employee Retention Tax Credit Expanded Under CAA

Jan 06, 2021

Prior to the passage of the Consolidated Appropriations Act, 2021, (CAA), the Employee Retention Tax Credit (ERTC) was as afterthought reserved to the deepest recesses of most employers’ minds as in the original CARES Act, taking a PPP loan and requesting subsequent forgiveness of that loan precluded businesses from also taking the ERTC. At best, the ERTC was a backup option for businesses that failed to request a PPP loan on time or had too many employees for the PPP loan. Now, however, with the passage of the Consolidated Appropriations Act, 2021 just days ago, the ERTC is retroactively available to employers even if they took a PPP loan.

The ERTC is a refundable payroll tax credit that can be taken against employment taxes equal to 50 percent of the qualified wages an employer pays to employees after March 12, 2020, and through December 31, 2020.

This post dives into the details of the ERTC and the mechanics of how employers can capitalize on this additional benefit.

The ERTC for 2020

As noted above, employers that borrowed a PPP loan can now also claim the ERTC for 2020 but not on the same dollars of payroll costs. What this means is wages and health care costs used in calculating the ERTC cannot also be used in deriving PPP loan forgiveness. Simply put, there’s no double-dipping. In order the qualify for the ERTC an employer must satisfy one of the following conditions:

- Full or partial suspension of business operations during any calendar quarter due to government orders limiting commerce, travel, or group meetings as a result of COVID-19 (this does not include individuals business choices or simple advisories by public officials), OR

- A significant (>50%) decline in gross receipts in a 2020 calendar quarter in relation to the same quarter in 2019.

If the significant gross receipts decline qualification is met, every quarter thereafter is considered a qualifying quarter until the first day of a calendar quarter following a quarter in which gross receipts returned to at least 80% of the gross receipts in the same quarter during 2019.

Example: Gross receipts for 2020 are $100,000, $150,000, $100,000, and $120,000 for Q1, Q2, Q3, and Q4 of 2019 respectively. Gross receipts are $45,000, $112,500, $83,000, and $90,000 for Q1, Q2, Q3, and Q4 of 2020 respectively. The employer would qualify for the ERTC beginning in quarter one since gross receipts decreased 55%. Quarter four would not be a qualified quarter since gross receipts rose back to 83% of the prior year’s receipts during the 3rd quarter.

If a business began in the middle of a quarter, gross receipts would be extrapolated to estimate the total quarter’s receipts. For example, if a business began on June 1st and reported $50,000 in gross receipts for the month, the business would use $150,000 of gross receipts for the 2nd quarter of 2019 ($50,000 x 3 months). Extrapolated gross receipts would be used for any prior quarter in 2019.

Once an employer has determined they qualify under one of the stipulations above, the next step is to determine on which wages to calculate the credit. First, in the event that a business is fully or partially suspended, only wages paid during the period of suspension can be used in calculating the ERTC. If the business qualifies based on the gross receipts test, the wages from each qualifying quarter can be used. The number of average monthly full-time employees (FTEs) significantly affects what wages can be used under either qualifying event. If the employer had less than or equal to 100 average monthly (FTEs) in 2019, then all wages paid to all employees during the eligible time period can give rise to a credit. If however, the employer had greater than 100 average monthly FTEs in 2019, only wages paid to employees during the eligible time period to NOT WORK are eligible for the credit. For purposes of this rule, and FTE is an employee who, for any calendar month in 2019, had an average of at least 30 hours of service per week or 130 for the month. This is not a fractional calculation. All employees working less than 30 hours count as zero FTEs in the average monthly calculation.

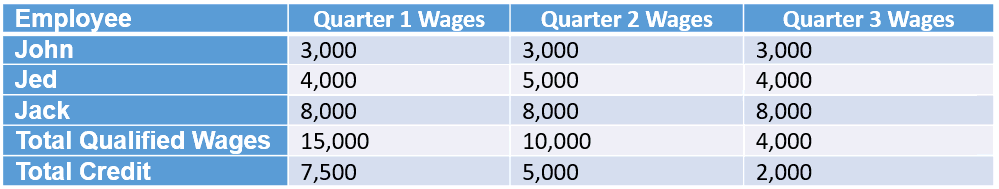

After considering all of the qualifications, the calculation of the credit is pretty straightforward. The ERTC is 50% of up to $10,000 of wages, including certain health insurance costs per employee per year. Let’s look at a simple example.

As seen in the table above, Jed’s quarter 3 wages are limited to $1,000 since $9,000 of his wages were already accumulated in quarters 1 and 2. Likewise, Jack’s wages are limited beginning in the second quarter and none of his wages are eligible in quarter 3.

One caveat to keep in mind when running the numbers on this credit is that wages up to the amount of the credit are not allowed as a deduction on the employer’s income tax return. So if an employer claims a $5,000 credit on $10,000 of wages, $5,000 of those wages are non-deductible for tax purposes.

As for businesses with multiple entities or subsidiaries, the following aggregation rules apply:

- if ONE business in the group has been partially or fully suspended, then all businesses in the group are considered to have been partially or fully suspended

- when calculating the percentage decline in gross receipts quarter over quarter, the gross receipts of ALL aggregated businesses must be taken into account

- when determining FTEs for purposes of the 100 FTE threshold, employees from all of the businesses in the group must be added together

Finally, in order to claim this credit, the employer can use one of two approaches. First, employers will report their total qualified wages and related health insurance costs for each quarter on their quarterly payroll tax returns (Form 941 for most employers). The credit is then taken against amounts that would have otherwise been deposited including federal income tax withheld, the employer’s share of Social Security and Medicare tax, and the employees’ share of Social Security and Medicare tax. The second acceptable method is to request an advance of the ERTC by submitting Form 7200.

OK – intermission. Stand up, stretch, use the restroom, and refill your coffee. We made it through the 2020 provisions of the Employee Retention Tax Credit. Next, we are going to breeze through the extension of the ERTC into 2021 provided by the Consolidated Appropriations Act, 2021. Here we go…

Changes for the 2021 ERTC Program

Congress voted to extend the ERTC into 2021 with the program set to end on June 30, 2021. The credit percentage has been increased from 50% to 70% and it is now calculated on $10,000 of wages per employee per quarter. In addition, the FTE threshold is up to 500 FTEs vs. 100 in 2020 and, what is considered a significant reduction in gross receipts quarter over quarter is down from greater than 50% to greater than 20%. Furthermore, congress tossed up a softball by including the provision that, when considering gross receipts for the first quarter of 2021, the employer can elect to compare Q4 of 2020 vs. Q4 of 2019 instead of Q1 of 2021 vs. Q1 of 2019 in the event that there’s a benefit to doing so.

One additional rule put in place for 2021 is that the advance credit claimed via Form 7200 cannot exceed 70% of the average quarterly wages paid in 2019.

As can be expected, the various allocations and calculations possible under the multitude of possible scenarios are far too comprehensive to include in the overview of this blog. When considering the ERTC for your business, do not hesitate to reach out to a William Vaughan adviser for assistance on maximizing the benefits of this program.

By: Jon Floering, CPA

Categories: COVID-19, Tax Planning