Employee Retention Tax Credit Expanded Under CAA

Jan 06, 2021

Prior to the passage of the Consolidated Appropriations Act, 2021, (CAA), the Employee Retention Tax Credit (ERTC) was as afterthought reserved to the deepest recesses of most employers’ minds as in the original CARES Act, taking a PPP loan and requesting subsequent forgiveness of that loan precluded businesses from also taking the ERTC. At best, the ERTC was a backup option for businesses that failed to request a PPP loan on time or had too many employees for the PPP loan. Now, however, with the passage of the Consolidated Appropriations Act, 2021 just days ago, the ERTC is retroactively available to employers even if they took a PPP loan.

The ERTC is a refundable payroll tax credit that can be taken against employment taxes equal to 50 percent of the qualified wages an employer pays to employees after March 12, 2020, and through December 31, 2020.

This post dives into the details of the ERTC and the mechanics of how employers can capitalize on this additional benefit.

The ERTC for 2020

As noted above, employers that borrowed a PPP loan can now also claim the ERTC for 2020 but not on the same dollars of payroll costs. What this means is wages and health care costs used in calculating the ERTC cannot also be used in deriving PPP loan forgiveness. Simply put, there’s no double-dipping. In order the qualify for the ERTC an employer must satisfy one of the following conditions:

- Full or partial suspension of business operations during any calendar quarter due to government orders limiting commerce, travel, or group meetings as a result of COVID-19 (this does not include individuals business choices or simple advisories by public officials), OR

- A significant (>50%) decline in gross receipts in a 2020 calendar quarter in relation to the same quarter in 2019.

If the significant gross receipts decline qualification is met, every quarter thereafter is considered a qualifying quarter until the first day of a calendar quarter following a quarter in which gross receipts returned to at least 80% of the gross receipts in the same quarter during 2019.

Example: Gross receipts for 2020 are $100,000, $150,000, $100,000, and $120,000 for Q1, Q2, Q3, and Q4 of 2019 respectively. Gross receipts are $45,000, $112,500, $83,000, and $90,000 for Q1, Q2, Q3, and Q4 of 2020 respectively. The employer would qualify for the ERTC beginning in quarter one since gross receipts decreased 55%. Quarter four would not be a qualified quarter since gross receipts rose back to 83% of the prior year’s receipts during the 3rd quarter.

If a business began in the middle of a quarter, gross receipts would be extrapolated to estimate the total quarter’s receipts. For example, if a business began on June 1st and reported $50,000 in gross receipts for the month, the business would use $150,000 of gross receipts for the 2nd quarter of 2019 ($50,000 x 3 months). Extrapolated gross receipts would be used for any prior quarter in 2019.

Once an employer has determined they qualify under one of the stipulations above, the next step is to determine on which wages to calculate the credit. First, in the event that a business is fully or partially suspended, only wages paid during the period of suspension can be used in calculating the ERTC. If the business qualifies based on the gross receipts test, the wages from each qualifying quarter can be used. The number of average monthly full-time employees (FTEs) significantly affects what wages can be used under either qualifying event. If the employer had less than or equal to 100 average monthly (FTEs) in 2019, then all wages paid to all employees during the eligible time period can give rise to a credit. If however, the employer had greater than 100 average monthly FTEs in 2019, only wages paid to employees during the eligible time period to NOT WORK are eligible for the credit. For purposes of this rule, and FTE is an employee who, for any calendar month in 2019, had an average of at least 30 hours of service per week or 130 for the month. This is not a fractional calculation. All employees working less than 30 hours count as zero FTEs in the average monthly calculation.

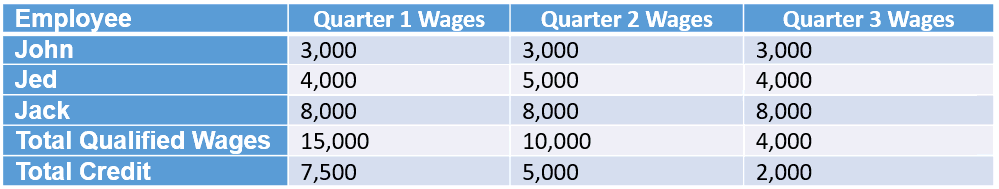

After considering all of the qualifications, the calculation of the credit is pretty straightforward. The ERTC is 50% of up to $10,000 of wages, including certain health insurance costs per employee per year. Let’s look at a simple example.

As seen in the table above, Jed’s quarter 3 wages are limited to $1,000 since $9,000 of his wages were already accumulated in quarters 1 and 2. Likewise, Jack’s wages are limited beginning in the second quarter and none of his wages are eligible in quarter 3.

One caveat to keep in mind when running the numbers on this credit is that wages up to the amount of the credit are not allowed as a deduction on the employer’s income tax return. So if an employer claims a $5,000 credit on $10,000 of wages, $5,000 of those wages are non-deductible for tax purposes.

As for businesses with multiple entities or subsidiaries, the following aggregation rules apply:

- if ONE business in the group has been partially or fully suspended, then all businesses in the group are considered to have been partially or fully suspended

- when calculating the percentage decline in gross receipts quarter over quarter, the gross receipts of ALL aggregated businesses must be taken into account

- when determining FTEs for purposes of the 100 FTE threshold, employees from all of the businesses in the group must be added together

Finally, in order to claim this credit, the employer can use one of two approaches. First, employers will report their total qualified wages and related health insurance costs for each quarter on their quarterly payroll tax returns (Form 941 for most employers). The credit is then taken against amounts that would have otherwise been deposited including federal income tax withheld, the employer’s share of Social Security and Medicare tax, and the employees’ share of Social Security and Medicare tax. The second acceptable method is to request an advance of the ERTC by submitting Form 7200.

OK – intermission. Stand up, stretch, use the restroom, and refill your coffee. We made it through the 2020 provisions of the Employee Retention Tax Credit. Next, we are going to breeze through the extension of the ERTC into 2021 provided by the Consolidated Appropriations Act, 2021. Here we go…

Changes for the 2021 ERTC Program

Congress voted to extend the ERTC into 2021 with the program set to end on June 30, 2021. The credit percentage has been increased from 50% to 70% and it is now calculated on $10,000 of wages per employee per quarter. In addition, the FTE threshold is up to 500 FTEs vs. 100 in 2020 and, what is considered a significant reduction in gross receipts quarter over quarter is down from greater than 50% to greater than 20%. Furthermore, congress tossed up a softball by including the provision that, when considering gross receipts for the first quarter of 2021, the employer can elect to compare Q4 of 2020 vs. Q4 of 2019 instead of Q1 of 2021 vs. Q1 of 2019 in the event that there’s a benefit to doing so.

One additional rule put in place for 2021 is that the advance credit claimed via Form 7200 cannot exceed 70% of the average quarterly wages paid in 2019.

As can be expected, the various allocations and calculations possible under the multitude of possible scenarios are far too comprehensive to include in the overview of this blog. When considering the ERTC for your business, do not hesitate to reach out to a William Vaughan adviser for assistance on maximizing the benefits of this program.

By: Jon Floering, CPA

Categories: COVID-19, Tax Planning

Americans Begin to Receive Second Round of COVID-19 Stimulus Checks

Dec 30, 2020

Tuesday afternoon, U.S Treasury Secretary Steven Mnuchin took to social media announcing the disbursement timeline for the second round of stimulus checks. He noted the following:

- Direct Deposit – Individuals who have direct deposit set up with the IRS can start looking for their second stimulus payments as early as last evening (12/29) and continue into next week.

- Paper Checks – The IRS will begin sending out paper checks today, Wednesday (12/30/20), which means people should begin receiving those checks within the next two weeks.*

- Status of Payment – Mnuchin also stated later this week, you can check the status of your payment here

*To speed up delivery, a limited number of people will receive their second stimulus payment by debit card. But the form of payment for your second stimulus check may be different than your first payment. Some people who received a paper check last time might receive a debit card this time, and some people who received a debit card last time could receive a paper check. The pre-paid cards will come in white envelopes that “prominently displays the U.S. Department of the Treasury seal,” the IRS said. The card will bear the Visa name on the front and the name of the issuing bank, MetaBank, will be on the card’s back. The information included with the card will explain that this is your Economic Impact Payment. There’s more information on the pre-paid cards here.

While Congress remains in discussion about an increase to a $2,000 stimulus amount, what we know for now is:

- As it currently stands, the checks will be for $600 for eligible adults, and $600 per dependent, meaning a family of four could receive $2,400.

- Individuals who earned less than $75,000 and those married filing jointly who earned less than $150,000 in 2019 are eligible for the full amount.

- Those who made more are eligible for reduced stimulus checks at a rate of $5 per $100 of additional income.

- The checks phase out completely for individuals that earned $87,000 and couples that made $174,000 in 2019.

If you have questions regarding your stimulus check, please contact your William Vaughan Company advisor or contact us at 419.891.1040. We’d be happy to help!

Categories: COVID-19

COVID Relief Bill Signed Into Law By President

Dec 28, 2020

The recent bill passed by Congress (Consolidated Appropriations Act [CAA]) finally became law after being signed by President Trump on Sunday, December 27th. It was feared disagreements over individual stimulus amounts and other various provisions deemed “wasteful spending” by the President would lead to a stalemate and ultimately to a pocket veto and subsequent death of the bill. Cooler heads prevailed, however, with businesses and individuals getting another financial shot in the arm. Below is a summary of the major highlights from the 5,600+ page law and the tax implications therein.

Individual Taxpayer Provisions

First and foremost, on the mind of most individuals impacted by COVID-19 are the second wave of stimulus payments and the unemployment benefits extension. Individuals will each be receiving a stimulus check in the amount of $600* ($1,200 per couple) as well as $600 per dependent child, e.g., a family of four will receive $2,400. These benefits will begin to phase-out when AGI reaches $75,000 ($150,000 for couples filing jointly) at a rate of $5 per $100 in excess of AGI thresholds. As with the first round of stimulus, these checks will be tax-free and will likely be reported as advance payment of credits on each taxpayer’s 1040.

*President Trump pushed back on this bill and advocated for stimulus checks of $2,000 per individual but staunch opposition from the Senate tabled these suggestions for what could be yet another stimulus under the next administration.

In addition to the $600 stimulus checks, Congress voted to extend the federal unemployment supplement albeit at a reduced rate of $300 per week (down from $600 under the CARES Act) through March 14, 2021. Along with the unemployment subsidy comes extensions of the Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC) programs as well.

Further notable tax provisions as they relate to individuals are as follows:

- Special charitable contribution deductions for non-itemizers of $300 ($600 for married filing joint returns) for the 2021 tax year

- Extended suspension of the 60% charitable contribution limitation through 2021

- Extended deferral period for employee’s share of Social Security tax to December 31, 2021

- Permanent extension of the reduced medical expense deduction floor (7.5% of AGI)

- Ability for lower-income individuals to use 2019 earned income to calculate earned income tax credit and a refundable portion of the child tax credit (helps those who had lower earned income in 2020 due to COVID-19 receive potentially larger refunds)

- Permits rollover of unused amounts in health and dependent care flexible spending arrangements

Business Taxpayer Provisions

The biggest provision of the Consolidated Appropriations Act, 2021 in the business arena was the decision to reverse the IRS position regarding the deductibility of expenses used for PPP loan forgiveness as well as a second wave of PPP loans. Details of these provisions can be found in our recent blog post here. For the purpose of this post, we will address the other main tax provisions for businesses found in the CAA.

The existing Employee Retention Tax Credit (ERTC) was modified retroactive to the beginning of the CARES Act. Before the passage of the CAA, businesses had to choose whether they would take advantage of PPP loan forgiveness OR claim the ERTC. Now, for 2020, businesses can request forgiveness of their PPP loans AND claim the ERTC. Provisions in the law state wages paid for with PPP loan proceeds cannot be used in calculating the ERTC in order to prevent double-dipping but for businesses with enough wages and other expenses to qualify for both, that option now exists. For 2020, the ERTC calculation is the same. The credit is capped at 50% of $10,000 of wages per employee for the year.

The law also provides for an extension of the ERTC into 2021 which increases the credit available to 70% of wages up to $10,000 per employee per calendar quarter. In addition, it raises the number of employees counted when determining relevant qualified wages from 100 to 500, reduces required year-over-year decrease in gross receipts from 50% to 20%, and clarifies that group health plan costs can be considered qualified wages EVEN WHEN no other wages are paid.

Other notable business provisions include:

- Extension of Families First Coronavirus Response Act (FFCRA) paid sick leave and expanded FMLA sick leave tax credits through March 31, 2021

- Full expensing of “restaurant” meals purchased in 2021 and 2022 provided other requirements for deductibility are met

- Five-year extension of the Work Opportunity Tax Credit (WOTC)

- Five-year extension of the employer credit for paid family and medical leave

- Extended suspension of the corporate 60% charitable contribution limitation through 2021

Due to the sheer volume of text in the Consolidated Appropriations Act, 2021, it is impossible to capture everything in this post. As always, please contact your William Vaughan adviser to discuss how we can help you navigate the myriad of provisions provided for by this law to best serve you and your business.

By: Jon Floering, CPA

Categories: COVID-19, Tax Compliance

Potential Fraud in Economic Injury Disaster Loan Program (EIDL) Program

Nov 03, 2020

The Small Business Association (SBA) issued a report back in July 2020 stating ‘serious concerns’ of potential fraud related to the EIDL Program. The SBA’s inspector general raised red flags about more than $78 billion in aid approved for businesses under the agency’s program — about 37% percent of the total amount distributed — and warned billions might have been fraudulently obtained by individuals taking out loans on behalf of companies.

WVC has received reports of this happening in Northwest Ohio. Fraudsters have taken loans out on behalf of companies and it isn’t until those companies apply for a legitimate new loan or go through a bank review are the fraudulent EIDL loans discovered.

As of today, the Federal Trade Commission has calculated $170 million in fraud losses related to COVID-19 of which roughly $2 million has occurred in Ohio and $3 million in Michigan. Cybercriminals began capitalizing on the ever-changing pandemic from the moment it began. It is unfortunate to hear, but a reality of the world we live in today.

As fraudsters exploit the ongoing pandemic, we wanted to share with you the suggested steps our in-house Risk Services Leader, Tiffany Pollard, recommends should you find yourself in a similar position:

- Work directly with the banking institution which experienced the fraudulent EIDL transaction and inquire if they will provide coverage for credit monitoring; and,

- Review the FTC website with recommendations on what to do when your personally identifiable data has been compromised:

a. https://www.identitytheft.gov/Steps

b. https://www.identitytheft.gov/Info-Lost-or-Stolen

To prevent such fraud, here are some recommendations you can do now:

- Activate credit monitoring at the three credit bureaus for your business and personal credit.

- Work with your banking institution to ensure you are using the available financial transaction monitoring available to detect fraud.

- Ensure you have cybersecurity and identity theft expense reimbursement insurance. Cybersecurity and identity theft insurance can help you pay for expenses associated with resulting losses and provide tools to reduce the risk of additional fraud.

- Complete a Security Assessment by an independent cybersecurity team. This evaluates current information technology systems to identify vulnerabilities and review the dark web for possible user name and password loss. Completing a preventative assessment can give you peace-of-mind knowing you have mitigated vulnerabilities within your network.

Having plans in place before such an issue occurs will enable your business to confidently manage such a tense situation. If you have any questions, please reach out to your WVC Advisor to Tiffany Pollard directly. WVC is here to help you.

Tiffany Pollard, CISA

Risk Services Practice Leader, William Vaughan Company

Tiffany.pollard@wvco.com | 419.891.1040

Categories: COVID-19

Looking for Additional COVID-19 Relief Funds?

Nov 02, 2020

Main Street Lending Program

On Friday, October 30, the Federal Reserve Board adjusted the terms of the Main Street Lending Program to better support smaller businesses that employ millions of workers and are facing continued revenue shortfalls as a result of the pandemic. The program supports lending to small and medium-sized for-profit businesses and nonprofit organizations that were in sound financial condition before the COVID-19 pandemic but lack access to credit on reasonable terms.

Yet so far the program has made just 400 loans for a total of $3.7 billion — far below the $600 billion in total funding that the Fed has said it is willing to lend. In an effort to boost participation in the program, the Federal Reserve Board made the following changes to ease lending stipulations along with waiving fees.

- Minimum loan amount lowered – The minimum loan size for three Main Street facilities available to for-profit and non-profit borrowers has been reduced from $250,000 to $100,000 and the fees have been adjusted to encourage the provision of these smaller loans.

- Prior loan assistance rules modified – The Fed also tweaked rules about the degree to which prior loan help from the federal government (PPP loans) can be counted in a company’s application, with an eye toward trying to make the Main Street lending program more accessible to small and midsized businesses.

Additional detail about this program can be found at https://www.federalreserve.gov/monetarypolicy/mainstreetlending.htm

For assistance with considering your options under the Main Street Lending Program or with finding a participating lender, contact your WVC advisor.

Economic Injury Disaster Loan (EIDL) – Request a Loan or Increase to Your Existing Loan

When the COVID-19 related EIDL loans were announced, they were capped at $2 million. The SBA was quickly inundated with EIDL applications and capped the loan amount to $150,000. Additionally, the SBA stopped accepted applications for all but agricultural businesses for several months.

EIDL applications were re-opened in June 2020.

Additionally, since EIDL loans are no longer capped at $150,000, you may request an increase to your existing COVID-19 EIDL. To request an increase to your EIDL, log into your EIDL account or send an email that states your need for an increase to the loan amount to pdcrecons@sba.gov with the word “INCREASE” in the subject line. Include any additional information that may assist the SBA in considering an increase in your application such as:

- Your most recent Federal income tax return for your business along with a signed IRS Form 4506-T, and /or

- Updated financials (Gross Revenue, Cost of Goods Sold, cost of operation, or other sources of compensation) submitted on SBA Form 3502, and

- An explanation of how COVID-19 has negatively impacted your business and why the additional funds are necessary.

For additional information on how EIDL loan terms and how the funds can be used, view our WVC Short on the topic.

Categories: COVID-19