Unemployment Insurance Benefits For Those Affected By COVID-19

Mar 18, 2020

The impact of COVID-19 around the United States is understandably worrisome. We’re providing this information to you regarding the latest news from the Trump administration and the State of Ohio’s unemployment benefits if you find that you have furlough all or some of your employees.

The administration also has announced this morning that the IRS will be deferring IRS payments from individuals and pass-through entities. If you owe a payment to the IRS, you can defer up to $1 million as an individual or pass-through entities and up to $10 million to corporations, interest-free and penalty-free, for 90 days.

The administration continues to work on the economic stimulus plan with Senators and House of Representatives, including loan guarantees, payments to small businesses, and payments to the American workers. After passage, they are hoping that checks to individuals can be made immediately – in the next 2 weeks.

Please rely on official sources, press conference details from national, state and local authorities, as we are, instead of media reports. We will do our best to summarize the guidelines for our clients as we understand that interpreting the messages from the CDC and Ohio Department of Health can be daunting. Besides official press conferences, our two main sources are:

- National Centers for Disease Control – Guidance for Businesses

- Ohio Business Gateway – Message to Employers

Unemployment Insurance Benefits

COVID-19 Pandemic Unemployment Payment is a new social welfare payment for employees and self-employed people who are unemployed or who have their hours of work reduced during the COVID-19 (coronavirus) pandemic. This includes people who have been put on part-time or casual work. You can apply for the payment if you are aged between 18 and 66 and have lost employment due to the coronavirus restrictions. Students can apply for the payment.

Here’s what we know as of this writing about Ohio’s unemployment insurance benefits for your employees:

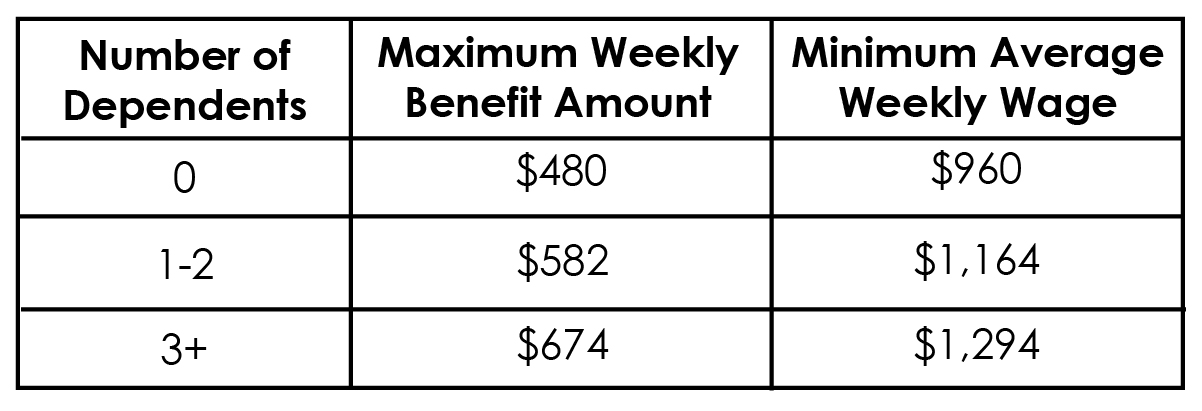

The weekly benefit amount is the amount of benefits employees may be entitled to receive for one week of total unemployment. Employees’ weekly benefit amount is computed at one-half of their average weekly wage during their base period (the base period is the 52 weeks prior to filing for unemployment). However, the weekly benefit amount cannot exceed the state’s annually established maximum levels (based on the number of allowable dependents claimed). The 2020 maximums for each dependency classification are given in the following table:

Example: $1200 average weekly wage X ½ = $600

Using this example, if an employee has 3 or more dependents, the weekly benefit amount would be $600 (as the maximum of $647 was not reached). However, if the employee had less than 3 dependents, the weekly benefit amount would be the maximum level allowable for fewer dependents (0 dependents = $480, while 1 or 2 dependents = $582).

NOTE: See below for information about deductible income and earnings which may reduce employee’s weekly benefit amount.

Employees must report all weekly income, including payments other than wages. In certain cases, the entire amount may be deducted from your benefits. Types of income that may be deductible include:

- Severance pay – Severance pay allocated by the employer to a week(s) following the date of separation is deductible from unemployment benefits.

- Vacation pay

- Pensions

- Company buy-out plans

- Workers’ Compensation

Employers can offer de minimis benefits (small amounts) like gift cards – generally under $75.

The waiting period of one week for unemployment benefits has been waived in Ohio. The Governor said employers will not be penalized for their employees filing for unemployment.

Filing for Unemployment Insurance Benefits

Ohio has two ways to file an application for Unemployment Insurance Benefits:

- Online – http://unemployment.ohio.gov – 24 hours/day, 7 days/week. Service may be limited during nightly system updating.

- Telephone – Call toll-free 1-877-644-6562 Monday through Friday 8 AM – 5 PM.

To apply for Unemployment Insurance Benefits, employees will need:

- Social Security number

- Driver’s license or state ID number

- Name, address, telephone number, and e-mail address

- Name, address, telephone number, and dates of employment with each employer worked for during the past 6 weeks of employment

- The reason why the worker has become unemployed from each employer

- Dependents’ names, Social Security numbers, and dates of birth

- If claiming dependents, their spouse’s name, Social Security number, and birth date

- Regular occupation and job skills – but employees will not have to actively search for jobs during this period.

- For your business and healthcare practices, there may be tax savings, low-interest loans through the SBA if other credit financing options are NOT available. The stimulus package being discussed is for individuals and certain small businesses under 500 employees.

Other Important Considerations

Business Interruption Insurance – Most businesses have, or should have business interruption insurance. You are urged to check with your business insurance broker to see if you have such coverage, determine if this qualifies, and what you need to do to receive reimbursement from your insurance company for your loss of business income. Up-to-date financial and payroll information will be critical.

Employment for dental workers – Healthcare workers are needed everywhere and it’s possible employees trained in HIPAA and other health safety precautions may be able to find work elsewhere. (Some requirements for HIPAA requirements have been waived for telehealth options.) Also, hospitals and medical centers are looking to dental offices to share the number of masks, gloves, etc., they have on hand.

As always, please call your William Vaughan Company advisor with any questions.

Categories: Other Resources