How to Deal With Expected Variances

Aug 06, 2015

I’m currently working with a client facing an unusual new year. This business is on a fiscal year and has just begun its new year on July 1. Due to radical changes in the marketplace, the company is expecting very low activity in its manufacturing area during the next 12 months. This is a multi-plant operation which experiences strong seasonality and during most years, all the plants run at full capacity particularly during the busy season.

However, this year, the conditions have changed and now it is likely none of the location’s will operate a full-time schedule. In fact, every location will be on part-time hours at some point during this fiscal year. The circumstances surrounding these reduced hours will create huge inefficiencies in the plant, as well as his dramatic underutilization of assets. As a result, large variances will be created in labor, material and overhead.

However, this year, the conditions have changed and now it is likely none of the location’s will operate a full-time schedule. In fact, every location will be on part-time hours at some point during this fiscal year. The circumstances surrounding these reduced hours will create huge inefficiencies in the plant, as well as his dramatic underutilization of assets. As a result, large variances will be created in labor, material and overhead.

The president and I have discussed how to deal with all the issues surrounding these facts and circumstances, but until the actual facts are known, much of what we can anticipate are just estimates at this time.

It does seem as though we will have to recognize the substantial variances as a portion to be inventoried. In the past, this business had relatively small variances and in effect, all variances were expensed as part of the operating cycle. However, this year these variances will be substantially larger and, therefore, will need to be allocated to inventory for both book and tax purposes. These apportioned variances could be so material as to drive the cost of inventory so high it would violate the GAAP requirement that the inventory be maintained at the lower of cost or market.

There is a formula required by generally accepted accounting principles that must be followed in the calculation of what is an acceptable cost. And although GAAP rules require apportionment of variances, as do tax rules, there is a market limitation which also must be taken into consideration.

GAAP rules do allow some latitude when dealing with variances caused by underutilized plant capacity. In this case, fixed overhead allocation can be based on normal activity and excess fixed costs can be charged to expense in the period incurred.

However, other costs must be included in inventory unless it can be shown they are the result of unusual production expenses such as a plant relocation, natural catastrophe or a labor strike.

The requirement to capitalize a portion of these excess costs in inventory does create a situation which may require a lower cost market (LCM) calculation. For example, if a product normally sells at a price of $1.00 and the normal fully loaded cost is $.75, then the gross margin would be $.25.

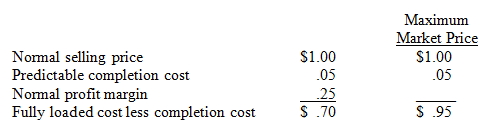

GAAP rules require net realizable value be used to determine the market price for finished goods. In this case, if commissions and shipping costs of $.05 per unit represent the only reasonably predictable costs of completion and disposal, the minimum and maximum net realizable value would be completed this way. The inventory value based on the maximum market price for this product would be $.95. If allocated variances would drive the unit cost to $.85, the inventory would not have to be written down until it exceeded $.95. This would still result in a 13% increase in the inventory carrying cost for this product. (.10/.75). All of this assumes the $1.00 selling price will not change because of market conditions.

The inventory value based on the maximum market price for this product would be $.95. If allocated variances would drive the unit cost to $.85, the inventory would not have to be written down until it exceeded $.95. This would still result in a 13% increase in the inventory carrying cost for this product. (.10/.75). All of this assumes the $1.00 selling price will not change because of market conditions.

Although GAAP requires this to be done on an item-by-item basis, the blogor market concept can be applied on a combined basis for reasonable groupings of like items if the method most clearly reflects periodic income.

If events unfold as they are expected in the upcoming 12 months, it doesn’t seem likely this business will be transferring much higher inventory values. Even if we are going to be limited by our capitalization of variances to the lower of cost or market rules. It is a very undesirable alternative to transfer into future years high-priced inventory which will further reduce margins in the new year. It is unavoidable. However, if activity in the current year is so reduced that huge efficiency variances will be incurred.

As these facts unfold during the upcoming year, our reaction to the variances created as well as the effect on inventory carrying values will be the topic of a future blog.

Categories: Cost Accounting