An FSA Keeps Taxes Away!

Dec 18, 2013

They say, “an apple a day keeps the doctor away.” That may be true, but if not and you do incur medical expenses I say, “an FSA today can bring savings your way.” The FSA I am referring to is a health flexible spending arrangement. An FSA is a cafeteria program established by employers that employees can use to reimburse medical expenses. FSAs are typically funded through an employee’s voluntary salary reduction agreement, and the salary that is withheld to fund the FSA is excluded from an employee’s gross income and is not subject to federal income or FICA taxes. Thus, the savings that are available to you if you take advantage of your employer offering an FSA program.

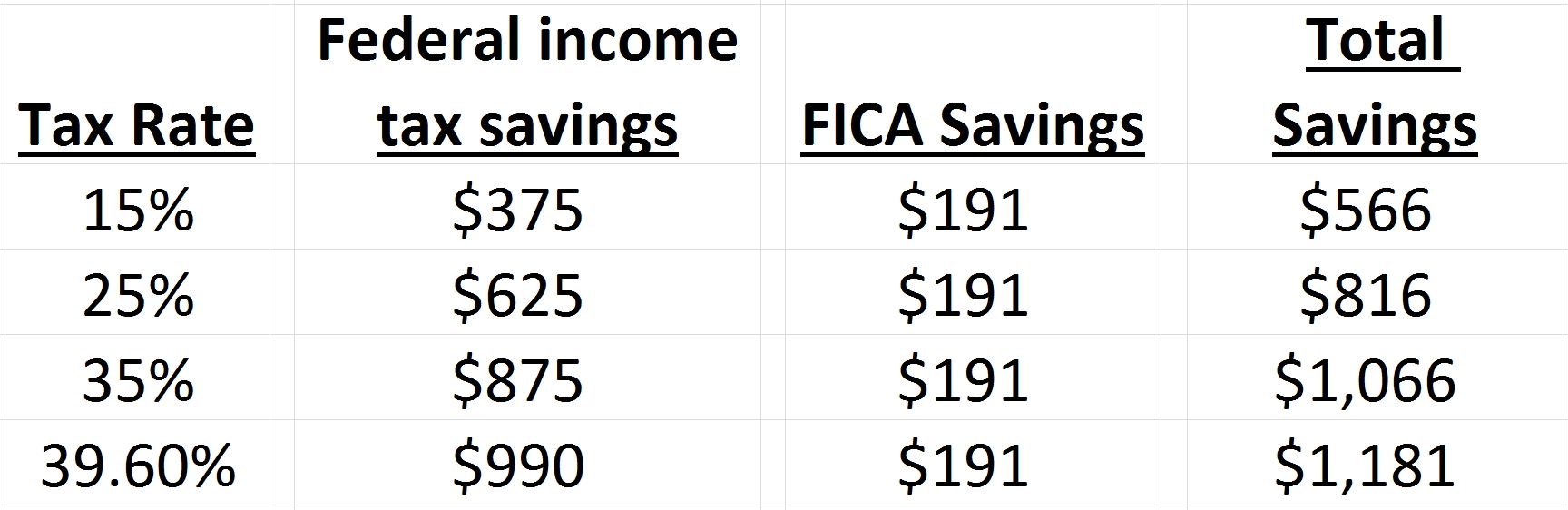

Employees are able to request salary reductions for a health FSA of up to $2,500. This results in a savings of $191 for the employee’s portion of FICA. The potential tax savings for various income tax brackets are as follows for an individual who contributes the maximum $2,500 to an FSA:

As you can see from the above table, health FSA plans are a great tax savings opportunity and the benefit is even greater for individuals with higher taxable incomes. For individuals in the 39.6% tax bracket, they are effectively paying 53 cents on the dollar for the $2,500 of qualified medical expenses they are reimbursed for.

Qualified medical expenses may be incurred by an individual, their spouse and all dependents claimed on their return. To receive the reimbursement for the medical expense you must provide a written statement stating what the medical expense was for and the total amount. Additionally, rather than paying for the medical expense yourself and then being reimbursed, an employer may provide a debit or credit card to employees to use to pay for qualified expenses and the employee will just need to provide the written statement to support the expenditure.

The IRS provides a full list of all qualified medical expenses with Publication 502. Some of the qualified medical expenses included on Publication 502 are:

- Chiropractor visits

- Eyeglasses and contact lenses

- Dental treatment, including teeth cleaning, fluoride treatments, cavity fillings and braces

- Laser eye surgery

- Annual physical examinations

- Prescription medications (note that over the counter medications do not qualify)

An employee can sign up for a health FSA at the beginning of the plan year and must designate how much they want to contribute at that time. One caution of the health FSA is that it is considered a use it or lose it plan. The full designated amount must be used for qualified medical expenses, and typically any amounts not used cannot be refunded to you. An exception is that plans can allow a grace period of 2 ½ months after the plan year end in which expenditures incurred in the current period can be reimbursed from any amounts left from the prior period. A second option is that $500 of unused amounts remaining at the end of the plan year may be carried forward to the next year as long as the 2 ½ month grace period mentioned above is not in effect.

Health FSAs can provide significant tax savings for medical expenses that most of us incur anyway. If you are not currently enrolled in an FSA plan, check with your employer to see if you can start cashing in on these benefits as well.

By: Mark Sawyer, CPA

Categories: Healthcare & Dentistry