Additional Medicare Tax Creating Withholding Problems

Oct 31, 2013

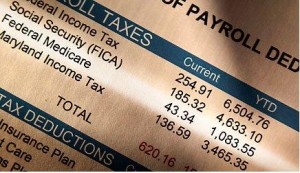

Effective at the beginning of 2013, employees and self-employed individuals are required to pay an additional 0.9% Medicare tax on wages in excess of $250,000 for married filling joint filers, $125,000 for married individuals filling separately, and $200,000 for all other filers. Employers, while not subject to this additional Medicare tax, are required to withhold this additional 0.9% Medicare tax on wages paid to an employee in excess of $200,000, beginning in the pay period in which wages exceed this amount. This requirement can potentially create withholding problems for many taxpayers.

These potential issues arise from the fact that employees are subject to the tax based on thresholds that are dependent on a person’s filing status. However, employers are required to withhold this additional 0.9% Medicare tax on wages paid to an employee in excess of $200,000, regardless of filing status, any additional wages this employee or his spouse earns, or any self-employment income this employee may have received. This requirement may result in individuals paying more or less than they actually owe.

These potential issues arise from the fact that employees are subject to the tax based on thresholds that are dependent on a person’s filing status. However, employers are required to withhold this additional 0.9% Medicare tax on wages paid to an employee in excess of $200,000, regardless of filing status, any additional wages this employee or his spouse earns, or any self-employment income this employee may have received. This requirement may result in individuals paying more or less than they actually owe.

For example, say a taxpayer earns $230,000, his spouse earns $120,000 and they file a joint return. The taxpayer’s employer will withhold the additional Medicare tax on the $30,000 in excess of the $200,000 threshold and the spouse’s employer will not withhold any additional Medicare tax because her earnings did not exceed the threshold. However, the couple actually owes the additional 0.9% Medicare tax on $100,000, the difference between their combined wages of $350,000 and the $250,000 married filling joint threshold, so their withholdings do not sufficiently cover the tax owed. In another example, say a taxpayer earns $230,000, his spouse has no earnings, and they file jointly. The taxpayer’s employer withholds the additional 0.9% Medicare tax on the $30,000 in excess of $200,000, as required. However, the couple actually owes no additional Medicare tax because their combined earnings do not exceed the $250,000 married filling joint threshold. In this case, employees cannot request their employer to stop or reduce the withholding, because any employer that does not meet the requirements, regardless of taxpayer liability, is subject to penalties. Employees will instead have to claim a refund when they file their 2013 tax return.

To ensure compliance with this additional 0.9% Medicare tax there are some actions employers, employees, and self-employed individuals can take. Employers should be checking their payroll systems to make sure they have started withholding the additional tax where necessary, employees should be looking to see if additional withholding may be necessary, based on their individual situations, and self-employed individuals should be making sure they are paying the proper amount of estimated tax payments. All of these actions should be considered with the help of your William Vaughan Company tax adviser.

By: Ruben Becerra, Staff Accountant

Categories: Uncategorized