New Tiered Structure for Ohio Commercial Activities Tax

May 01, 2014

The new tiered structure could mean more annual minimum tax due in May. Note that the CAT rate of 0.26% remains unchanged and continues to apply to those taxpayer’s with taxable gross receipts over $1 million (the first $1 million in taxable gross receipts are excluded from the calculation of a taxpayer’s CAT liability.)

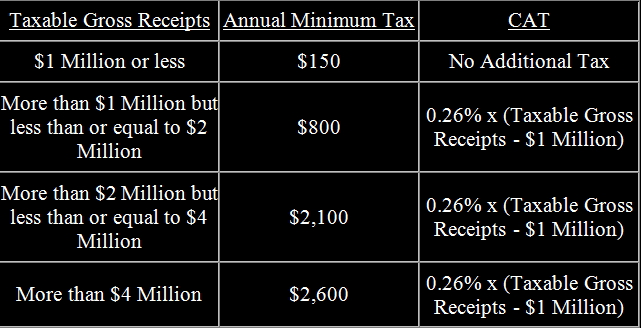

All CAT taxpayers pay an annual minimum tax which is due with calendar year taxpayers’ annual returns or with the quarterly taxpayers’ first quarter returns, due May 10th of each year. For 2013, the annual minimum tax was $150. For tax periods beginning on January 1, 2014 and thereafter, the annual tax will be a tiered structure. The taxpayer will utilize its previous calendar year’s taxable gross receipts to determine the current year’s annual minimum tax. Those taxpayers with $1 million or less in taxable gross receipts will still pay $150 annual minimum tax (no change). The annual minimum tax for taxpayers with total taxable gross receipts of more than $1 million but less than or equal to $2 million will be $800; for taxpayers with taxable gross receipts more than $2 million but less than or equal to $4 million will be $2,100; and for taxpayers with taxable gross receipts in excess of $4 million will be $2,600.

Please refer to the chart below provided by the Ohio Department of Taxation:

Example: XYZ Corp. (XYZ) is a quarterly taxpayer. XYZ reports cumulative taxable gross receipts of $2.5 million for the reporting period of January 1, 2013 to December 31, 2013 (all four quarters of 2013). When XYZ files its first quarter 2014 return in May, 2014, the annual minimum tax associated with XYZ for 2014 will be $2,100. Assume that on its first quarter 2014 return, XYZ reports taxable gross receipts of $1,200,000 for the first quarter of 2014. XYZ’s total tax due with that return is $2,620, which includes the $2,100 annual minimum tax, plus $520 CAT (0.26% x ($1,200,000 – $1,000,000 Exclusion).

By: Jenny Furey, CPA

Categories: Uncategorized