Could Your Drug Policies Go Up In Smoke?

Oct 02, 2015

On November 3rd, Ohioans will vote on the legalization of medicinal and recreational use of marijuana. However, this proposed amendment is leaving many questions unanswered for Ohio’s employers. One of the biggest questions is whether or not employers can terminate current employees or deny employment to new hires based on a failed drug test. This question was answered by the Colorado Supreme Court on June 15th, 2015.

Brandon Coats, a quadriplegic and former employee of Dish Network, was granted a medical marijuana license by the state of Colorado in 2009 to control violent spasms and seizures caused by a paralyzing car accident when he was a teenager. In 2010, he was terminated for failing a random drug test after using medical marijuana while off-duty. Coats claimed to have been wrongfully terminated based on the Lawful Off-Duty Activities Statute which state employees cannot be discharged based on “lawful” activities performed while off-duty. Coats battled this for five years through trial court, Court of Appeals, and State Supreme Court. However, all three came to the exact same ruling. The statute only applied to activities deemed lawful under both state and federal law. Because the use of marijuana, both recreational and medicinal, is illegal according to federal law, Dish Network had the right to stand by their drug-free workplace policies and terminate Brandon Coats under valid circumstances.

Brandon Coats, a quadriplegic and former employee of Dish Network, was granted a medical marijuana license by the state of Colorado in 2009 to control violent spasms and seizures caused by a paralyzing car accident when he was a teenager. In 2010, he was terminated for failing a random drug test after using medical marijuana while off-duty. Coats claimed to have been wrongfully terminated based on the Lawful Off-Duty Activities Statute which state employees cannot be discharged based on “lawful” activities performed while off-duty. Coats battled this for five years through trial court, Court of Appeals, and State Supreme Court. However, all three came to the exact same ruling. The statute only applied to activities deemed lawful under both state and federal law. Because the use of marijuana, both recreational and medicinal, is illegal according to federal law, Dish Network had the right to stand by their drug-free workplace policies and terminate Brandon Coats under valid circumstances.

We know going forward this will be an ongoing issue for both employers and employees if this amendment passes. We encourage all employers to review their workplace policies pertaining to both on-duty and off-duty drug use and clarify any language that could present itself as a gray area, should any incidents occur in the future.

By: Halie Baker, Staff Accountant

Categories: Healthcare & Dentistry

What You Don’t Know…

Sep 11, 2015

Can hurt you, particularly concerning potential retiree medical expenses. Misconceptions about the Affordable Care Act (ACA), health care costs and what Medicare will pay in terms of long-term care expenses could upset many Baby Boomers’ plans for a comfortable retirement.

How much could my retiree medical expenses be? You might be surprised. The Employee Benefit Research Institute* estimated the amounts people who turned age 65 in 2014 will need for a 50%, 75% and 90% chance of covering Medicare and Medigap health insurance premiums and out-of-pocket drug costs during retirement. Those amounts:

- For men — $64,000, $93,000 and $116,000, respectively

- For women — $83,000, $106,000 and $131,000, respectively

- For married couples — $147,000, $199,000 and $241,000, respectively

The figures are for people with median prescription drug costs. If you have higher costs, you’ll need more. Further, the estimates don’t include long-term care expenses.

Would long-term care expenses add that much more? They could. An average stay in a nursing home — 2.2 years for men and 3.7 years for women — would add about $185,000 to the amount a man might need and more than $300,000 to the amount a woman might need.**

Would long-term care expenses add that much more? They could. An average stay in a nursing home — 2.2 years for men and 3.7 years for women — would add about $185,000 to the amount a man might need and more than $300,000 to the amount a woman might need.**

Don’t the ACA and Medicare cover long-term care expenses? Provisions for long-term care coverage were included in the ACA, but the program wasn’t implemented. And while Medicare does cover some skilled nursing home expenses following a hospital stay, it generally doesn’t cover the costs of continuing custodial care. Medicaid can provide coverage, but you’ll have to exhaust most of your financial resources first.

What options do I have? Basically, you can pay long-term expenses out of pocket, or you can protect yourself and your loved ones by purchasing long-term care insurance. Also, consider that life insurance proceeds could replace assets used to pay medical and long-term care expenses. Talk with your financial professional about preparing for potential retiree medical expenses.

- ebri.org, Notes, Volume 35, No. 10, October 2014

** Long-Term Care: What Are the Issues?, Robert Wood Johnson Foundation, 2014, and LongTermCare.gov

Categories: Healthcare & Dentistry

Will You Have To Report Under The Affordable Care Act (ACA) in 2015?

Aug 25, 2015

As you may have heard, the Supreme Court recently ruled on the legality of premium tax credits paid through federally (rather than state) administered health benefit exchanges. The Court came down in favor of President Obama’s administration. After careful analysis of the ACA’s tax credit provisions, it was determined that tax credits for insurance purchased on any exchange created under the ACA are allowable.

What the decision means to individuals and businesses:

For individuals that are receiving or could receive tax credits to assist with the purchase of health insurance, the decision is good news. Any decision to overturn the availability of tax credits in states with federally run exchanges would have had an immediate impact on individuals living in those states; and would likely have a negative impact on the health insurance marketplace nationally, impacting the cost of insurance.

For individuals that are receiving or could receive tax credits to assist with the purchase of health insurance, the decision is good news. Any decision to overturn the availability of tax credits in states with federally run exchanges would have had an immediate impact on individuals living in those states; and would likely have a negative impact on the health insurance marketplace nationally, impacting the cost of insurance.

For middle market and larger businesses this means the potential penalty taxes for failing to provide affordable and meaningful health insurance coverage (the ACA’s employer shared responsibility provisions) will continue to be in effect.

One of the key elements for businesses with 50 or more full-time employees or equivalents is compliance with the ACA’s information reporting requirements that started in 2015 (reporting due by Jan. 31, 2016). Thus, for businesses that have been waiting for the outcome of this case before committing the time and financial resources necessary to develop reporting systems to meet that requirement, now is the time to act.

For questions or additional information about this alert please contact us.

Categories: Healthcare & Dentistry

Creating the Patient Encounter

Jul 22, 2015

The patient encounter has become increasingly more important to practice leaders. In fact, the patient experience has become critical to the success of many dental practices.

What is the patient encounter and how do you incorporate it into your culture? Patient encounter is influenced by all contact stages of an organization and it starts from the time a patient first makes contact with a practice and continues through various phases of the patient cycle.

People. Caring for our patients and the interactions during their care have a great impact. When everyone seizes ownership in the patient experience, each employee’s role is expanded and the practice’s culture is changed.

Process. To effectively deliver a positive patient experience, provider organizations have to have clear processes in place. These processes have to stretch into each touch point a patient has with the organization. Not only do these processes help organizations be more efficient, but safeguards a harmonious experience in all components of the practice.

Process. To effectively deliver a positive patient experience, provider organizations have to have clear processes in place. These processes have to stretch into each touch point a patient has with the organization. Not only do these processes help organizations be more efficient, but safeguards a harmonious experience in all components of the practice.

Place. This goes beyond the physical location of the organization. Patient experience goes beyond interacting with patients in our offices it begins as soon as they call to schedule an appointment or when they are sitting in a crowded waiting room for extended periods of time. All of these factors significantly have an effect on a patient’s overall experience with the practice.

Improving the patient encounter by focusing on culture is arising as an essential approach leading to lasting positive outcomes. A great patient encounter to the right patient, at the right time, makes that patient feel like they are your only patient.

Categories: Healthcare & Dentistry

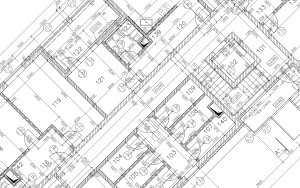

Cost Segregation Study

Jul 16, 2015

A cost segregation is an engineered study which segregates property into appropriate Federal Income Tax Depreciation classifications while maximizing depreciation expense. This enables you to accelerate depreciation on components of the aforementioned real property from 39 or 27.5 years to 5, 7, or 15 years. If you have purchased, constructed, remodeled, or otherwise acquired real estate after January 1, 1986, you qualify for this service.

According to the Journal of Accountancy, “the major advantage of cost segregation is not necessarily that it will produce more depreciation deductions. Instead, due to the time value of money, the advantage of these front-loaded deductions will be quantifiably greater than had the deductions been spread over longer periods of time using slower depreciation methods.” Cost segregation studies are an excellent way to increase your tax savings and generate cash flow related to real estate assets.

An engineered-based cost segregation study is preferred by the IRS. A wide range of building components, such as electrical installations, plumbing, mechanical components, and finishes can be identified and reclassified based on an engineer’s recommendations. Substantial savings can be identified with an engineered-based study: “In general, it is the most methodical and accurate approach, relying on solid documentation and minimal estimation.” In addition, the involvement of an accountant offers significant tax law knowledge and experience.Combined, these two experts will ensure a maximum depreciation deduction benefits are realized.

The following example is provided to illustrate the benefits that can be derived from cost segregation:

A newly constructed commercial building valued at $1,000,000 would normally be depreciable over 39 years without a cost segregation study. However, an engineered study would reallocate components of this real property into accelerated lives of 5, 7, or 15 years. Let’s assume in this example that 25% of the total cost was allocated to both 5 and 7 year property, 10% was allocated to 15 year property and the remaining 65% remained allocated to 39 year property.

A newly constructed commercial building valued at $1,000,000 would normally be depreciable over 39 years without a cost segregation study. However, an engineered study would reallocate components of this real property into accelerated lives of 5, 7, or 15 years. Let’s assume in this example that 25% of the total cost was allocated to both 5 and 7 year property, 10% was allocated to 15 year property and the remaining 65% remained allocated to 39 year property.

Without the cost segregation, estimated total allowable depreciation amounts to approximately $14,000 in year 1 and $168,000 after 7 years. In contrast, the reallocation due to cost segregation may generate total allowable depreciation of approximately $204,000 in year 1 and $428,000 after 7 years.

The increased allowable depreciation produces significant tax savings and an immediate avenue for increased cash flow. In this example, gross tax savings for year 1 amounts to $85,500. Even after 7 years, the gap in allowable deductions remains considerable with $414,000 of increased accumulated depreciation that would have been otherwise deferred to later years.

Please note that the above example is for illustrative purposes only and does not reflect present value calculations or the results of state, local, and the alternative minimum tax.

William Vaughan Company offers cost segregation studies based upon guidance provided in the Internal Revenue Code, court cases, and construction cost manuals. Furthermore, the cost segregation analysis generated by William Vaughan Company’s professional team is tailored to fully comply with the IRS Cost Segregation Audit Techniques Guide. Please contact David A. Hammack, CPA/PFS or Nathan M. Bernath, CPA at 419-891-1040 with any questions or to schedule your FREE analysis.

By: Nate Bernath, CPA

Categories: Healthcare & Dentistry